There are various types of superannuation funds in Australia. As each type of fund has its own benefits and drawbacks, it’s important to do your research before deciding which one is right for you.

The five main types of superannuation funds in Australia are industry funds, retail funds, corporate funds, public sector funds and Self Managed Super Funds.

1. Industry funds

Industry funds are sector specific, and are usually set up by employers in a particular industry or sector, such as healthcare, manufacturing or hospitality.

These funds typically have lower fees than other types of super funds, and may offer additional benefits such as salary sacrificing and insurance.

If you’re looking for a super fund that offers low fees and great returns, an industry fund could be the right option for you.

2. Retail funds

Retail funds are offered by banks, insurance companies and other financial institutions.

These funds usually have higher fees than industry funds, but can offer a wider range of investment options so you can choose the fund that best meets your investment goals.

When selecting a retail fund, it is important to consider your investment objectives, risk tolerance, and time horizon.

You should also research the fund’s investment strategy, fees, and performance history.

3. Corporate funds

Corporate funds are usually offered by large employers as a benefit to their employees, and are usually only available to employees of those companies.

4. Public sector funds

Public sector funds are offered to employees of the public sector, such as state and federal government employees. The most common type of public sector fund is a pension fund, which is used to provide retirement benefits for public employees.

5. Self-managed superannuation funds (SMSFs)

A self-managed superannuation fund (SMSF) is a superannuation fund where the members are also the trustees. This means that the members of the SMSF are responsible for running the fund and making all the investment decisions.

An SMSF can give you a lot of flexibility and control over your retirement savings. You can choose where to invest your money and how to manage your assets.

However, running an SMSF is not for everyone. It can be a lot of work and you need to make sure you comply with the super laws.

If you are thinking about setting up an SMSF, you should speak to a financial adviser to see if it is the right option for you.

‘What Next?’

Check to see what type of fund(s) your super is currently invested in. Consider other options available to you to ensure you have the right one for your circumstances.

You can also download the eairwoman app to explore the various calculators and projections, including:

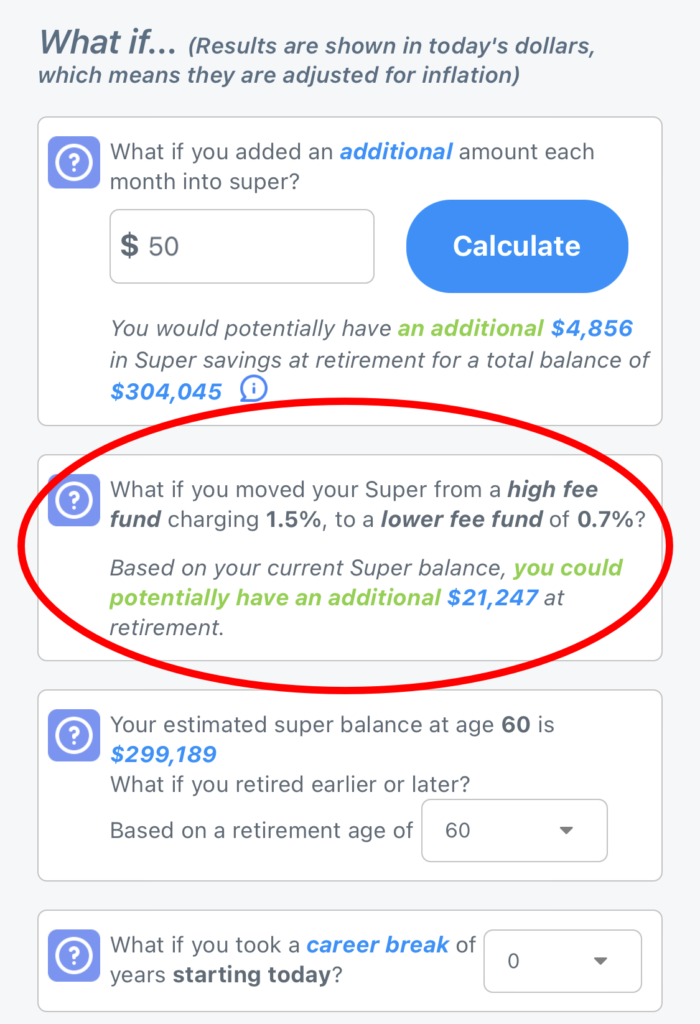

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

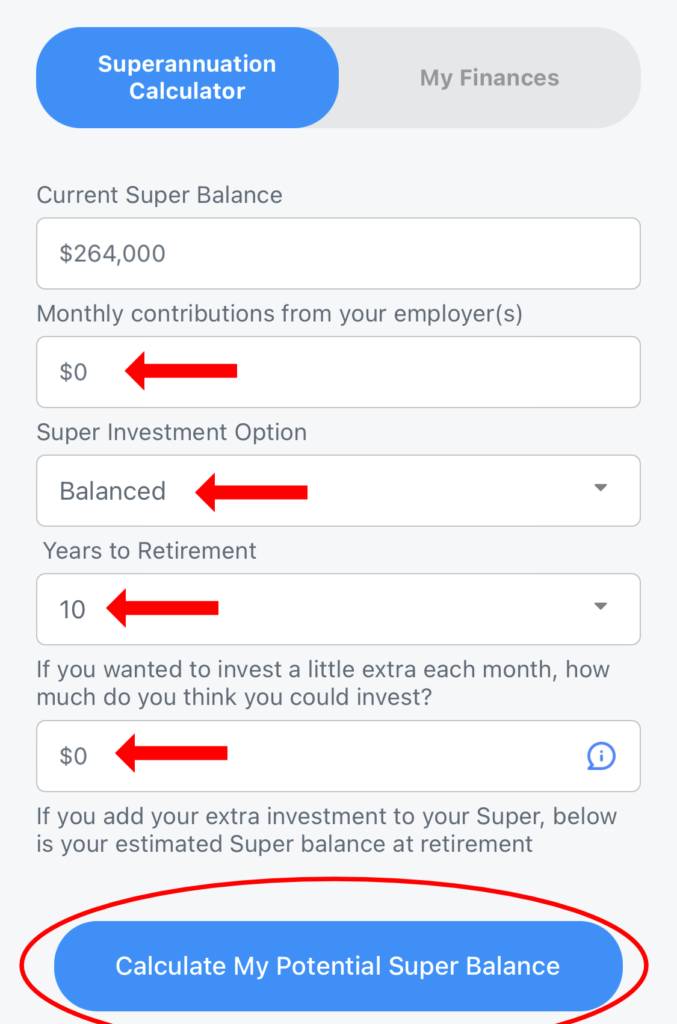

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance.