If you’re like most people, you probably don’t think much about retirement until you’re nearing the end of your working life. But whether you’re years or months away from retirement, it’s never too early to start thinking about how you’ll support yourself during those golden years.

One of the best ways to ensure a comfortable retirement is to plan ahead and set aside as much money as possible. But how much is enough?

The industry benchmark is the ASFA Retirement Standard which is the suggested minimum amount of money needed to support a ‘comfortable’ lifestyle in retirement.

The ASFA Retirement Standard is a set of guidelines that can be used by retirees to assess their level of income and expenditure in retirement. It is important to note that the Standard is not a prescriptive budget, but rather a benchmark that can be used to help retirees understand what is considered a ‘comfortable’ retirement lifestyle.

The standard sets out the minimum annual income required to maintain a ‘comfortable’ lifestyle in retirement. It is important to note that this is not the same as the Age Pension, which is the minimum level of income support provided by the government.

The standard is based on the premise that retirees should be able to maintain a good standard of living, including providing for daily essentials such as food and clothing, as well as additional items such as private health insurance and a modest level of leisure and recreation. It is assumed that the retirees own their own home outright and are relatively healthy.

As of March 2023, the ASFA Comfortable Standard suggests that a single person needs an annual retirement income of around $50,004, while a couple needs $70,482.

To achieve this income, retirees will need to have saved a Super balance of around $595,000 (for a single person) or $690,000 (for a couple).

The ASFA Retirement Standard provides a useful benchmark for Australians planning for retirement. It can help you assess whether you are on track to achieve the income you will need in retirement. However, it is important to remember that the ASFA Retirement Standard is not a one size fits all solution. There is no magic number that will guarantee a comfortable retirement. What is important is to make sure you are doing everything you can to save as much as possible. The sooner you start, the easier it will be to reach your retirement goals.

Further Reading:

The ASFA Standard is reviewed and updated quarterly. You can access the latest ASFA Retirement Standard here – https://www.superannuation.asn.au/resources/retirement-standard

What Next?

You can download the eairwoman app to explore the various calculators and projections, including:

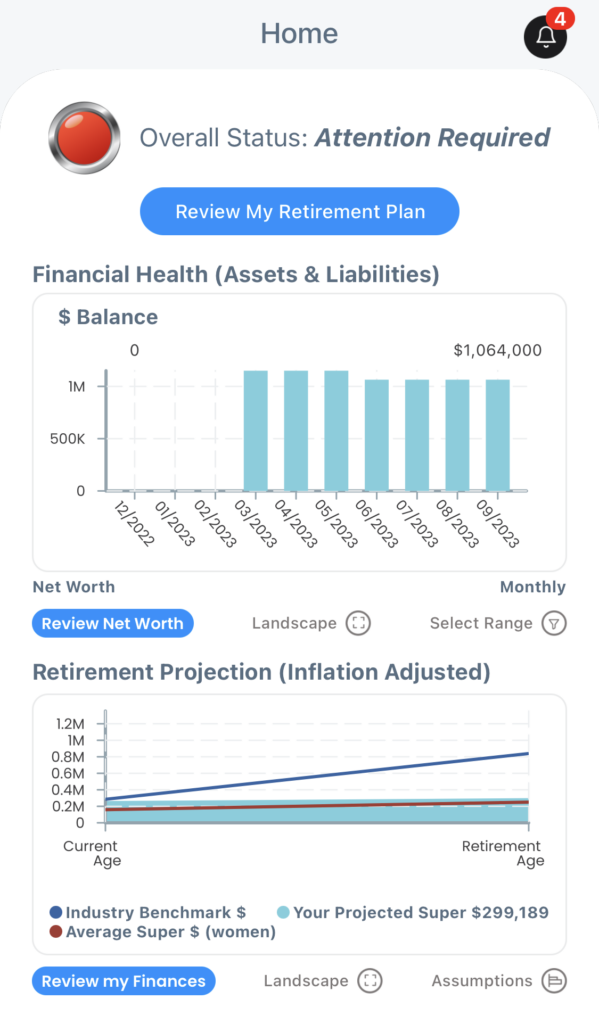

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection as compared to the ASFA Retirement Standard.

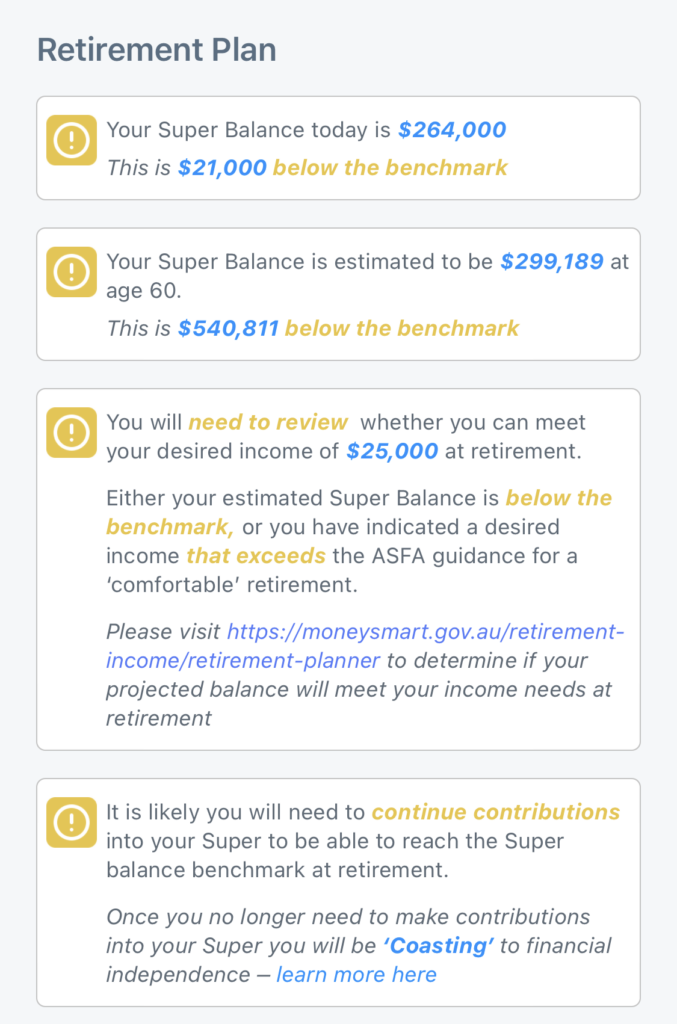

Retirement Plan – projections of your current retirement against the ASFA standard, along with ‘What If’ calculators to see what difference various scenarios would make.

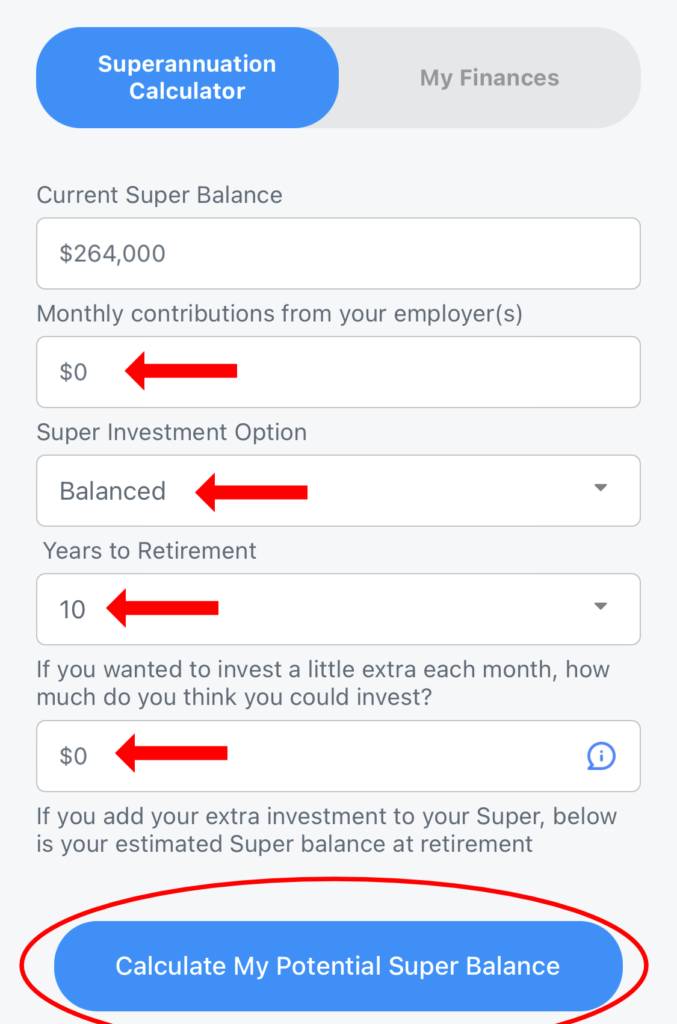

My Finances -> Superannuation Calculator – See what changes to investment options, contributions and retirement date would make to your superannuation balance.