If you’re an employee working in Australia, your employer is generally required to make super contributions on your behalf. This is called the Superannuation Guarantee (SG). These employer super contributions are a percentage of your before-tax salary and are paid into your super fund.

The contributions are in addition to any salary or wages you earn and are designed to help you save for your retirement. They are also in addition to any personal contributions that you may make.

There are a number of benefits for you. Firstly employer contributions are taxed at a lower rate than your usual income. This means that they can save you money in taxes and help you grow your super balance faster. Secondly, the contributions themselves will over time significantly boost your retirement savings.

If you’re self-employed, you can also make voluntary contributions to your super and claim a tax deduction for doing so. This can be a great way to boost your retirement savings and reduce your tax bill at the same time.

If you are not sure if you are entitled to super guarantee contributions, check your eligibility here – https://www.ato.gov.au/calculators-and-tools/am-i-entitled-to-super/

If you are unsure whether or not your employer is making contributions to your super, check your super statement or contact your super fund.

Remember that while employer contributions are important for your retirement, they are just one part of the equation. You also need to consider making your own personal contributions, as well as making sure you’re investing your super wisely.

A little goes a long way, and the sooner you start saving the better. Don’t forget to keep an eye on your investment options and make sure your super is working hard for you. With a little planning and effort, you can make the most of your employer contributions and secure a comfortable retirement.

Further Reading:

Superannuation Guarantee contributions rate and rules:

https://www.superguide.com.au/how-super-works/superannuation-guarantee-sg-contributions-rate

What Next?

Consider your options for making additional contributions to your super. This could be as regular ongoing contributions, or once off amounts.

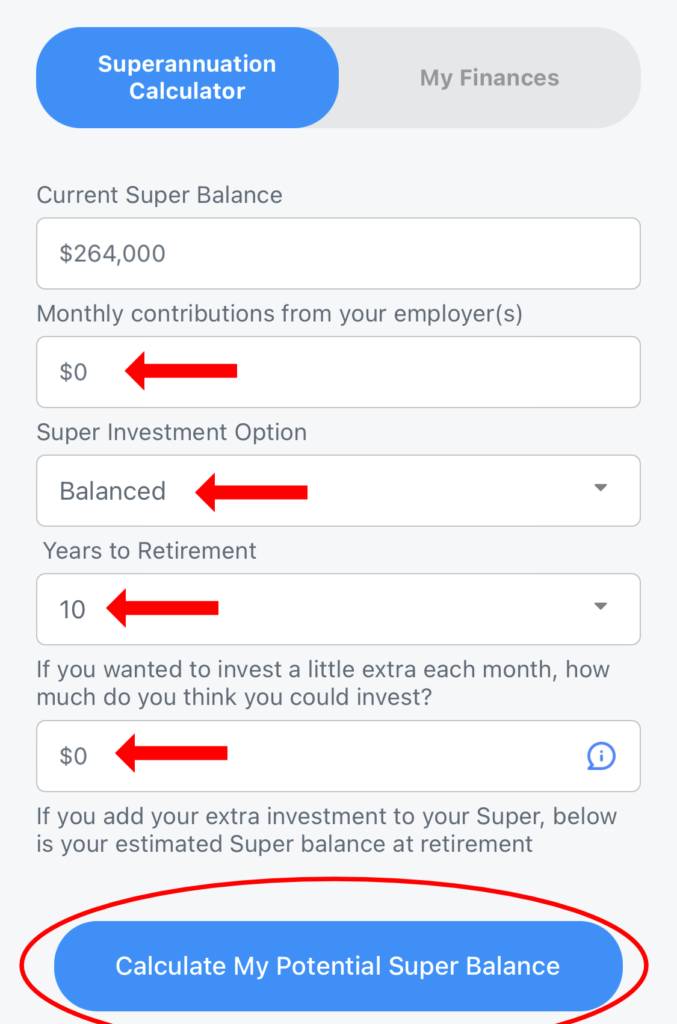

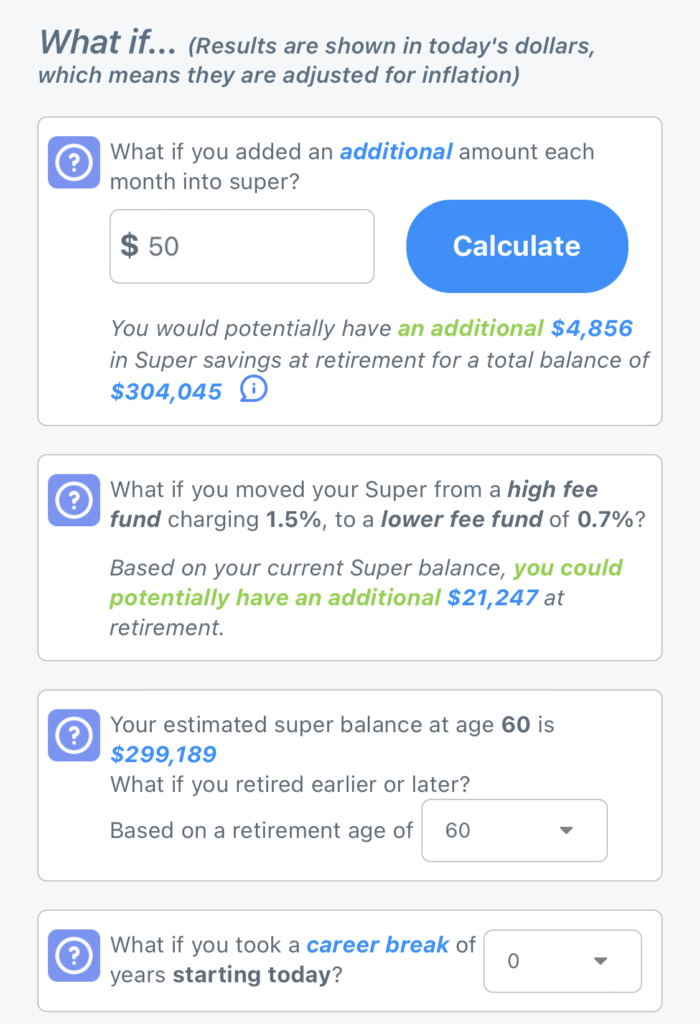

Download the eairwoman app to explore the various calculators and projections, including:

Retirement Plan – see what difference additional contributions, or investing a windfall rather than spending it, could make to your retirement balance.

My Finances -> Superannuation Calculator – See what changes to investment options, additional contributions, and delaying your retirement could make to your superannuation balance.