When it comes to choosing the right superannuation fund for you, it’s important to understand your risk appetite. Do you want a low-risk investment option, or are you willing to take on more risk for the potential of higher returns?

Generally speaking, there are three main risk levels when it comes to superannuation funds: low risk, medium risk and high risk.

Low risk investments tend to be more stable, with less chance of losing your money. They typically offer lower returns but are less volatile, meaning they’re less likely to go up and down in value. Examples of low risk investments include cash and fixed interest.

High risk investments are the most volatile and offer the highest potential returns. However, they also come with a higher risk of loss. Examples of high risk investments include mining shares, small cap equities and start up companies.

Medium risk funds sit somewhere in the middle offering a balance of risk and return.

Most super funds will give you the choice of where your money will be invested, and therefore the level of risk you are choosing. They will typically offer ‘pre-mixed’ options which allow you to choose from. The most common pre-mixed options being ‘Stable’/’Conservative’ (a lower risk strategy), ‘Balanced’ (medium risk strategy), and ‘High Growth’ being a high risk strategy.

The ‘Stable’/’Conservative’ option will invest mostly in fixed interest and cash, with potentially a small percentage of shares and property.

A ‘Balanced’ option will invest in a mix of shares, property and cash.

While the ‘High Growth’ option will invest mostly in shares and property, with possibly a small percentage of cash or fixed interest.

Note, the default option when you open a super account would typically be ‘Balanced’.

Which option is best for you?

When it comes to investing, there is no one-size-fits-all approach. Each investor has different goals, risk tolerance and time horizon.

Generally speaking, younger investors tend to have a higher risk appetite, as they have more time to ride out any short-term market volatility. Conversely, older investors or those closer to retirement may have a lower risk appetite, as they’re often more focused on preserving their capital.

If you’re not sure where to start, you can always seek professional advice from a financial adviser to find the right investment mix for you.

What Next?

Check to see where your super is currently invested. See what investment option you currently have selected and the associated level of risk. That is, what percentage are invested in shares, property, cash and fixed interest. Also review the fund performance and what fees you are paying. With this information you’ll be better informed when considering other super fund options available to you, and ensure you have the right one for your circumstances.

You can download the eairwoman app to explore the various calculators and projections, including:

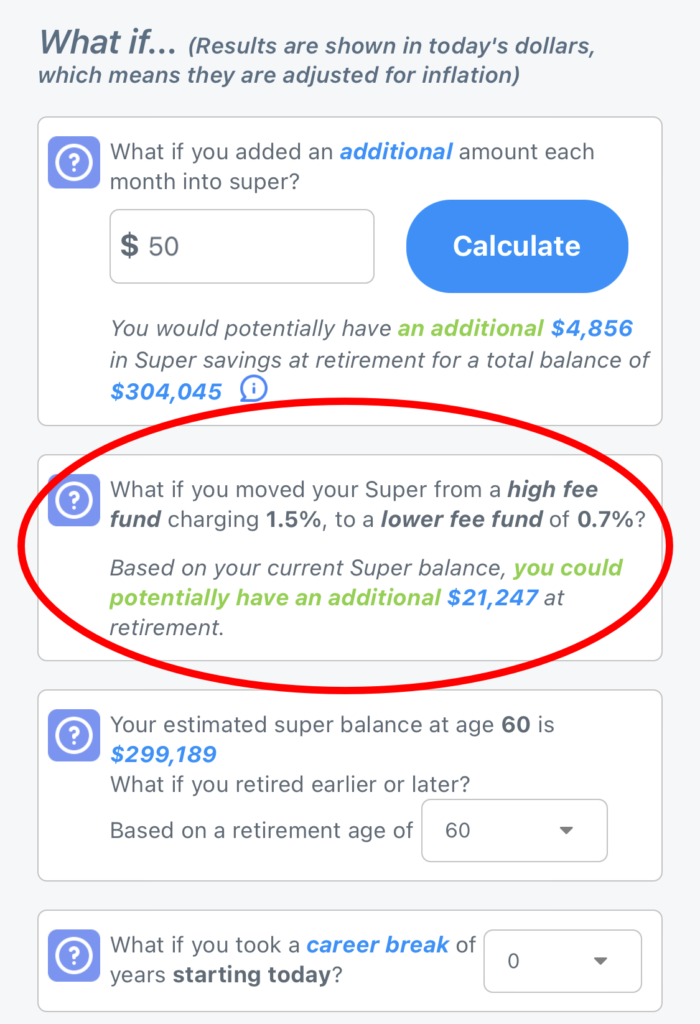

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

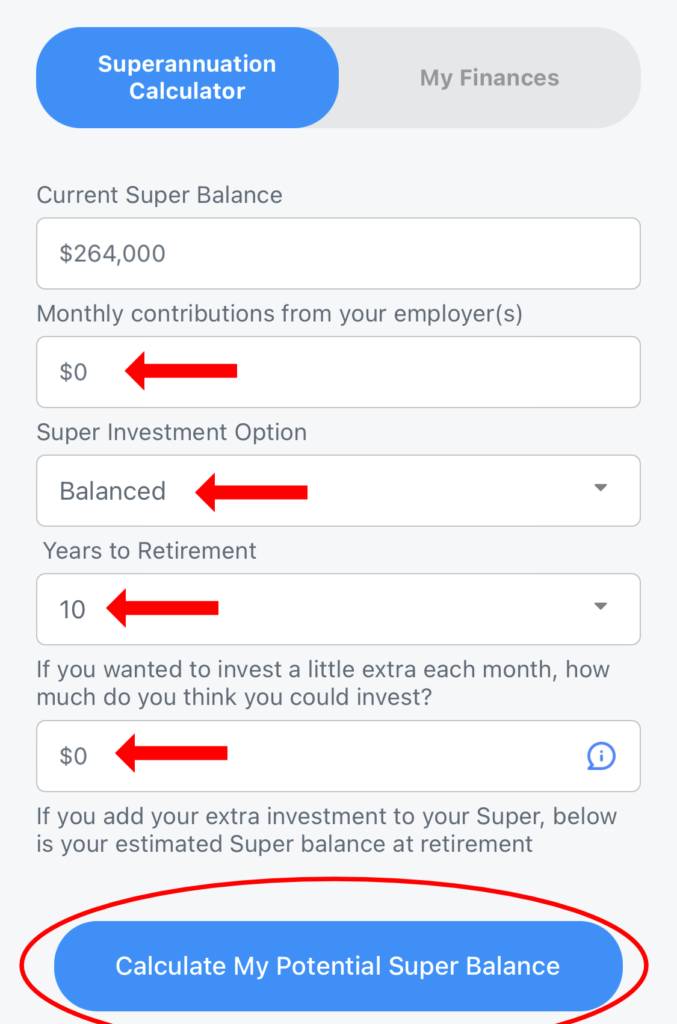

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance, including moving to a higher performing fund.