Inflation eats away at your retirement money every single day, of every week, of every year!

Therefore, it’s important to invest your money to offset the reduction of your spending power by inflation.

What is inflation?

Inflation is the rate at which prices for goods and services rise over time. In other words, inflation reduces the purchasing power of your money. The $100 you have today, won’t buy you the same amount in ten years’ time. Inflation has eroded your purchasing power.

What is the true impact of inflation on your savings?

Let’s say I invest my money for 10 years and receive a given rate of return (interest) on that money.

However, inflation has been making everything more expensive during the same ten years.

Assuming the average inflation is 3.5% every year, at the end of ten years everything will be 41% more expensive than it is today.

Therefore, I will have more money, but I will also pay a lot more for everything.

Inflation eats away at your retirement money every single day, of every week, of every year.

Therefore, it’s important to invest your money to offset the reduction of your spending power by inflation.

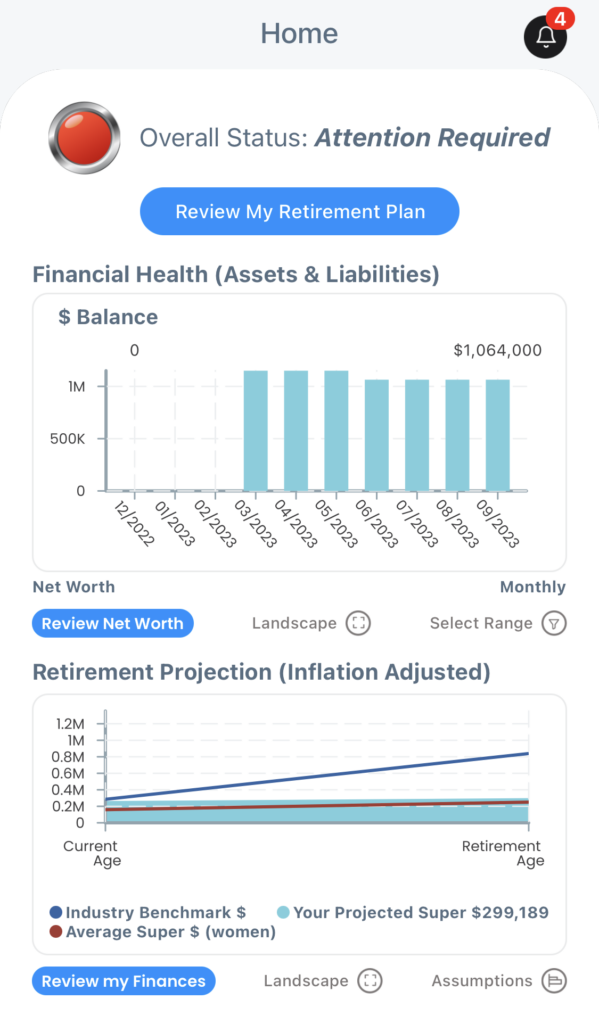

The eairwoman app has inflation adjustment built in. All calculations will be ‘adjusted for inflation’. This is to show what your investment earnings will be in ‘real terms’, that is, what your spending power will be but represented in today’s dollars. Note that super funds will advertise a rate of return. But this does not include inflation adjustment which will decrease your total rate of return.

Further Reading:

For more information on ‘Adjusted for Inflation’ see our FAQ and Support page at https://eairwoman.com/index.php/faq/

What Next?

You can download the eairwoman app to explore the various calculators and projections, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection as compared to the ASFA Retirement Standard.

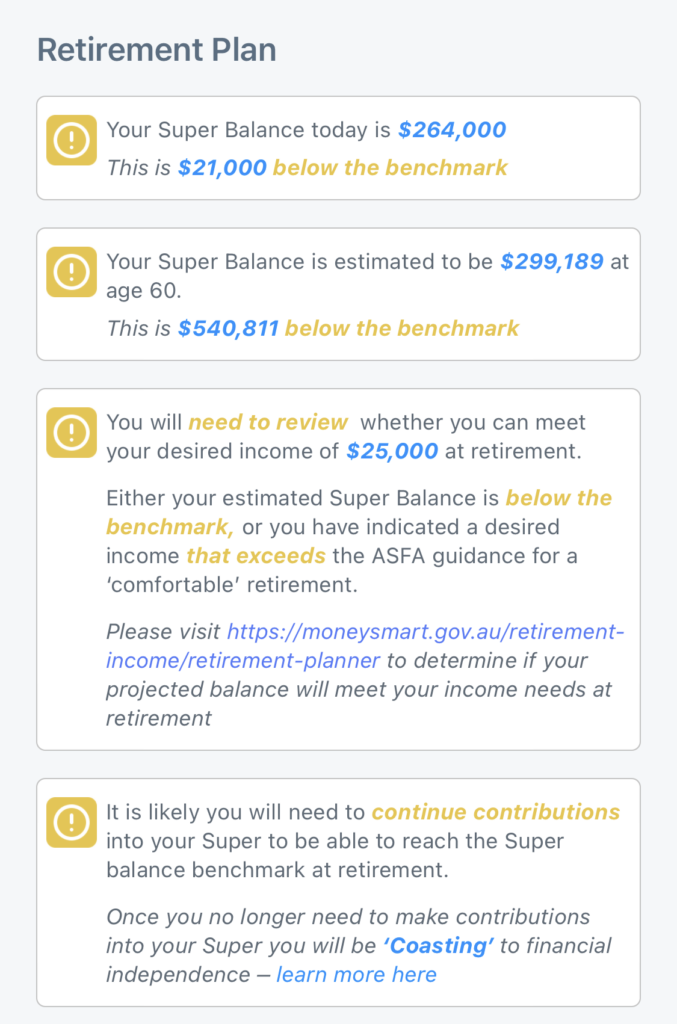

Retirement Plan – projections of your current retirement against the ASFA standard, along with ‘What If’ calculators to see what difference various scenarios would make.

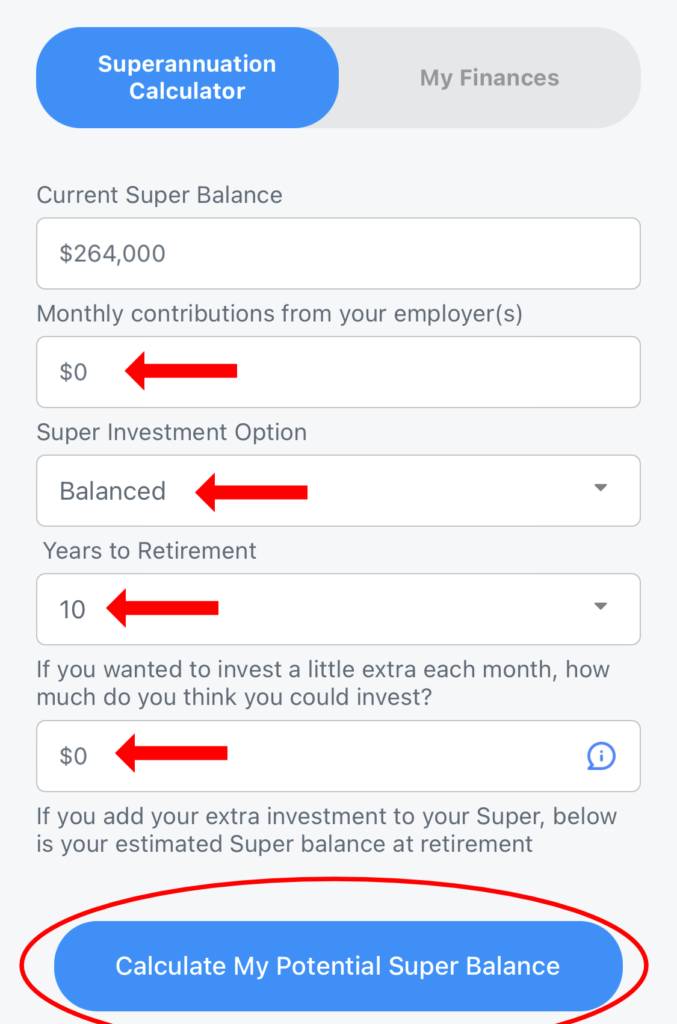

My Finances -> Superannuation Calculator – See what changes to investment options, contributions and retirement date would make to your superannuation balance.