When you choose to add your own money to your super fund, these are known as voluntary contributions. Over time these voluntary contributions can make a significant difference to your final super balance.

Salary Sacrifice:

This is when you make contributions from your gross salary. That is, contributions taken out of your salary before tax. The advantage is these amounts are taxed at a lower rate of 15%. The other advantage is they can be set up so the deduction is taken automatically on your behalf. Ask your employer how much of your gross salary you’d like to contribute each pay day. Note, there are tax rules and limits when you contribute in this way. See ‘Further Reading’ below.

Personal Contributions:

These are amounts you add directly to your super fund. Personal contributions do not include salary-sacrifice amounts, and are in addition to any compulsory super contributions made by your employer. Personal contributions allow you to decide when and how much you want to contribute. Note you will need to claim back any tax benefit when you lodge your tax return. There are tax rules and limits when you contribute in this way. See ‘Further Reading’ below.

Super co-contributions:

If you are a low or middle income earner you may be eligible to receive co-contributions from the government. The amount you receive will depend on your income and how much after tax money you contribute. Rules and limits apply, see ‘Further Reading’ below.

Spouse contributions:

Planning for your future shouldn’t always be about yourself, you should consider your family as well. If eligible, you can make super contributions for your spouse. For those who are eligible there are possible tax incentives for spouse contributions. Rules and limits apply, see ‘Further Reading’ below.

Further Reading:

ATO article ‘How to save more in your super’ –

https://www.ato.gov.au/individuals/super/growing-and-keeping-track-of-your-super/how-to-save-more-in-your-super/

What Next?

Consider your options for making additional contributions to your super. This could be as regular ongoing contributions, or once off amounts.

Download the eairwoman app to explore the various calculators and projections, including:

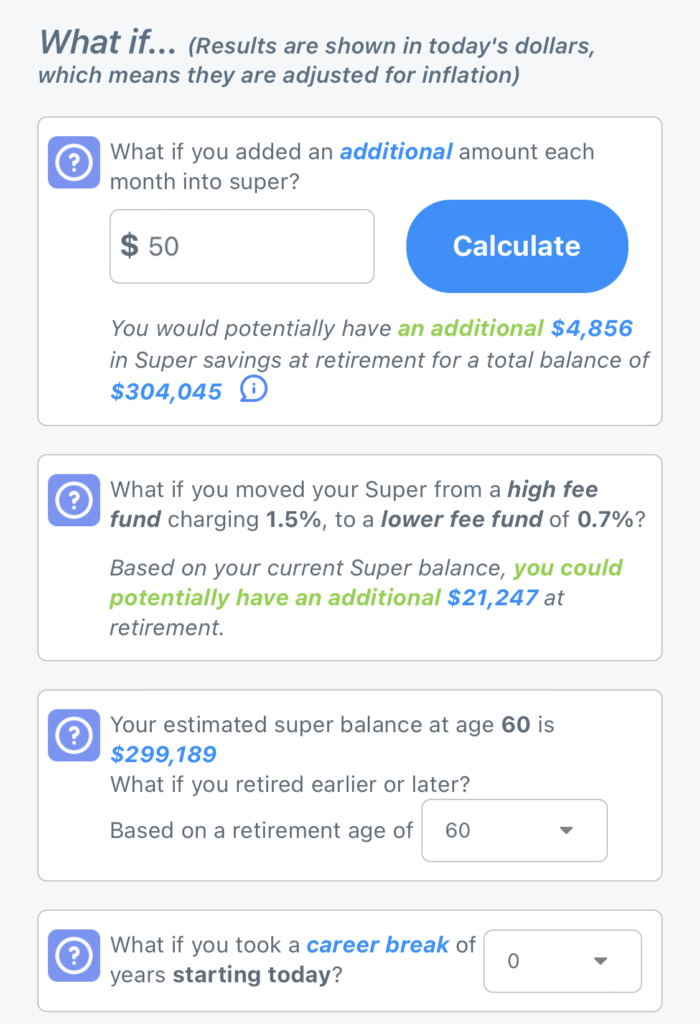

Retirement Plan – see what difference additional contributions, or investing a windfall rather than spending it, could make to your retirement balance.

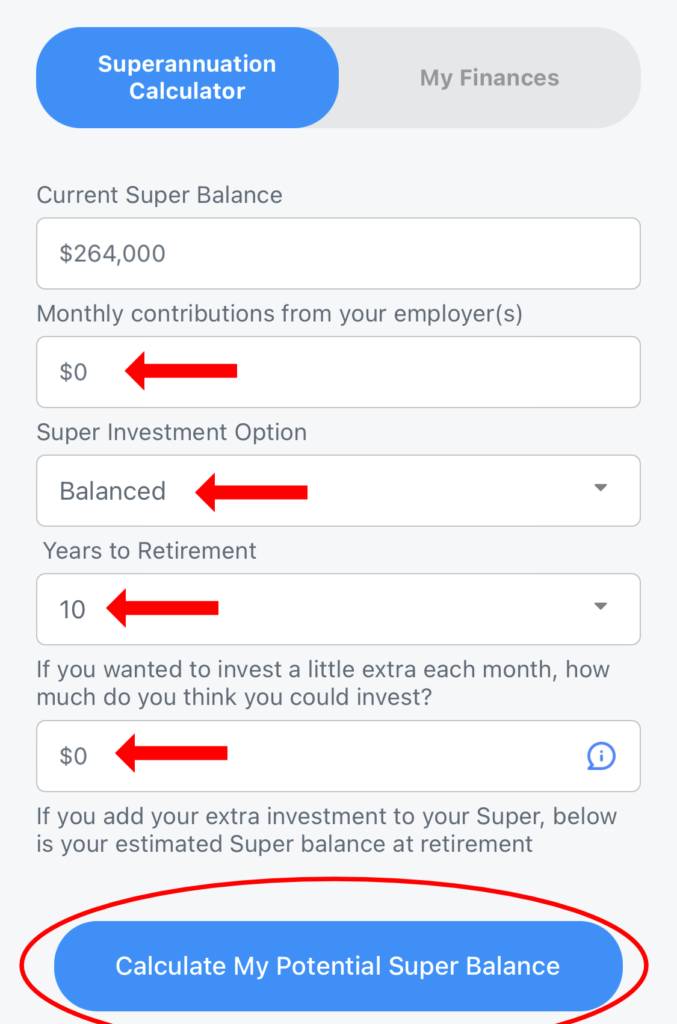

My Finances -> Superannuation Calculator – See what changes to investment options, additional contributions, and delaying your retirement could make to your superannuation balance.