As we approach retirement, many of us are looking forward to a time when we can finally relax and enjoy life. However, it’s important to be aware that our expenses may change after retirement.

For some of us, our expenses will actually go down after retirement. This is because we no longer have to worry about things like paying for childcare or commuting to work. Additionally, we may have paid off our mortgage by this point.

On the other hand, there are also a number of expenses that may go up after retirement. For example, we may need to pay for more medical care or travel.

It’s important to take a close look at our finances before we retire so that we can be prepared for any changes to our expenses.

What are my expenses likely to be in retirement and how much income do I need?

The good news is the ASFA Retirement Standard has done a lot of the work for you. The standard sets out the minimum annual income required to cover expected expenses and maintain a ‘comfortable’ lifestyle in retirement. This has been based on maintaining a good standard of living, including providing for daily essentials such as food and clothing, as well as additional items such as private health insurance and a modest level of leisure and recreation.

The other good news is the eairwoman app will show you how your retirement savings are tracking against the the ASFA Retirement Standard!

Of course, everyone is different. The ASFA retirement standard provides a useful benchmark for Australians planning for retirement. It can help you assess whether you are on track to achieve the income you will need in retirement. However, it is important to remember that the ASFA retirement standard is not a one size fits all solution. There is no magic number that will guarantee a comfortable retirement. What is important is to make sure you are doing everything you can to save as much as possible. The sooner you start, the easier it will be to reach your retirement goals.

Further Reading:

The ASFA Standard is reviewed and updated quarterly. You can access the latest ASFA Retirement Standard here – https://www.superannuation.asn.au/resources/retirement-standard

What Next?

Download the eairwoman app to record your household expenses, not just what they are today, but on going all the way up to retirement. You’ll find this under ‘My Finances’/’My Finances’/Income & Expenses

You can also use the eairwoman app to explore the various calculators and projections, including:

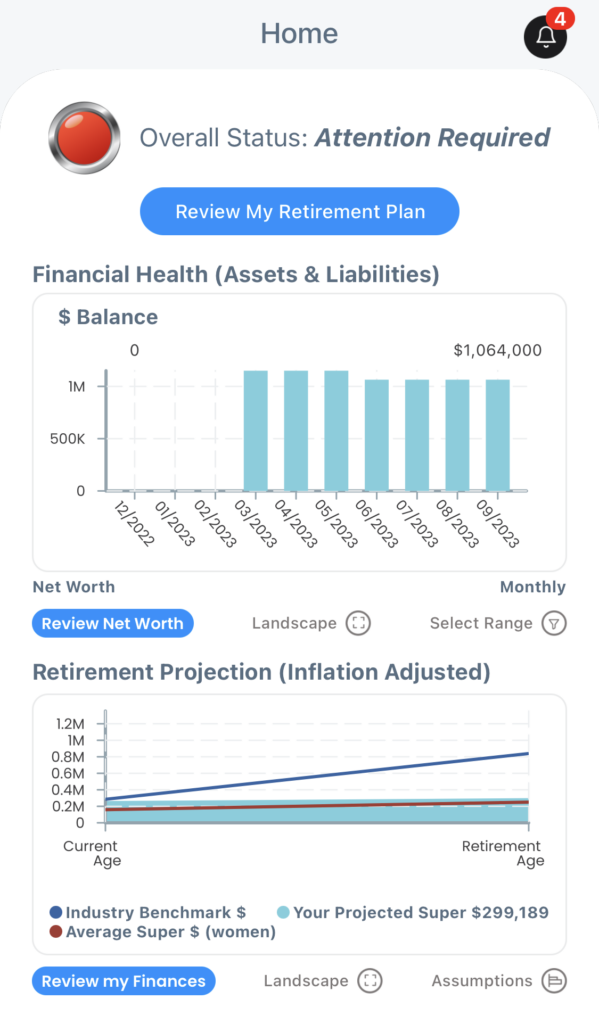

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection as compared to the ASFA Retirement Standard.

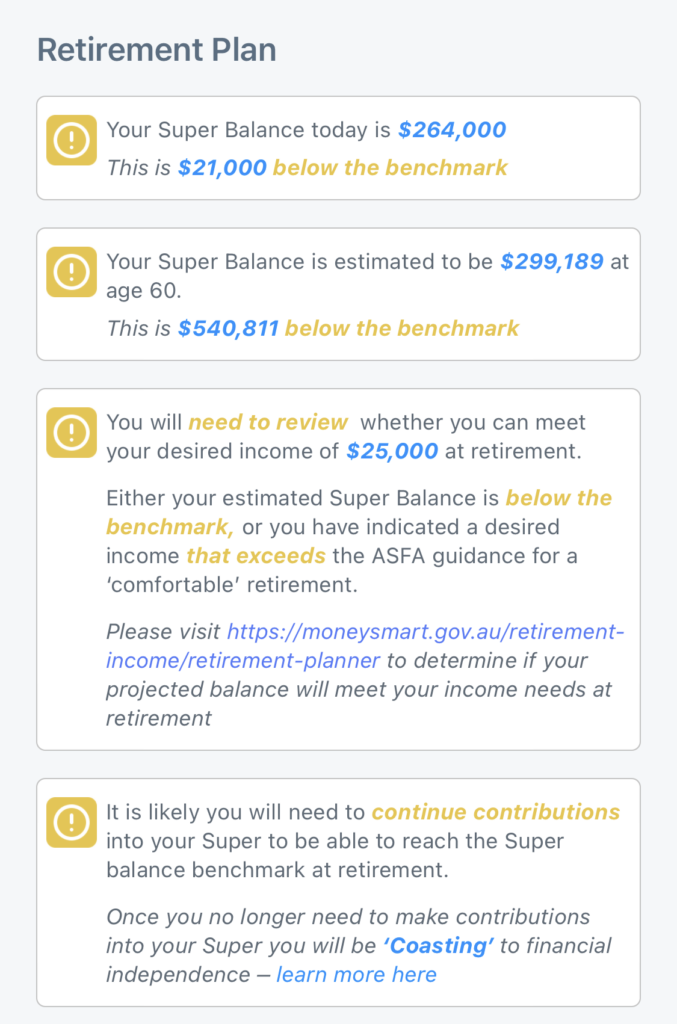

Retirement Plan – projections of your current retirement against the ASFA standard, along with ‘What If’ calculators to see what difference various scenarios would make.

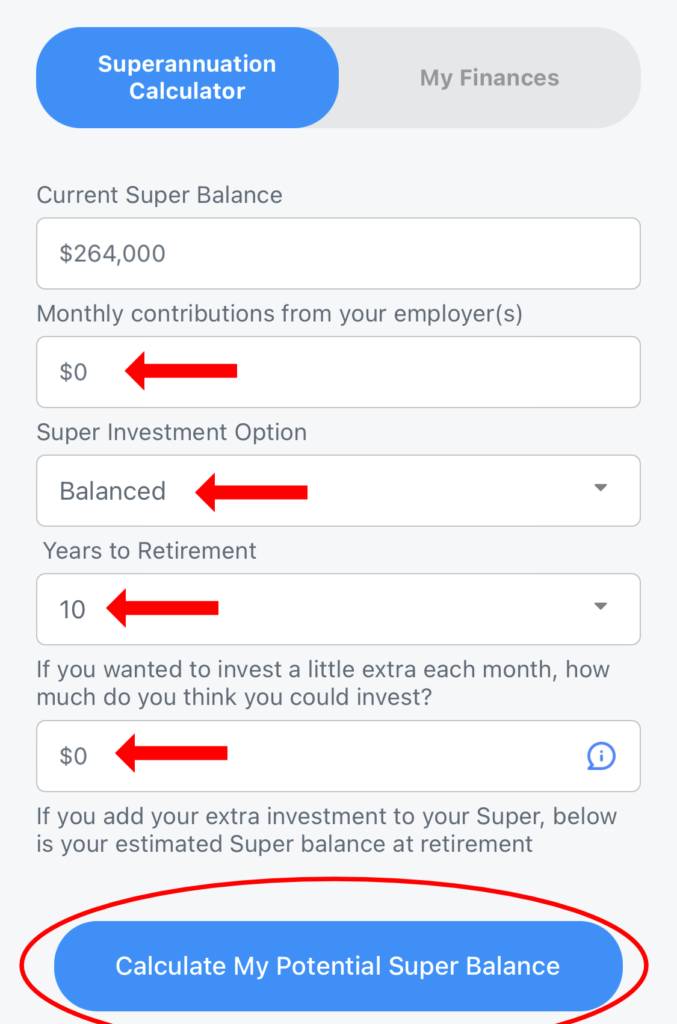

My Finances -> Superannuation Calculator – See what changes to investment options, contributions and retirement date would make to your superannuation balance.