If you’re like most people, you probably don’t think too much about your super fund. But did you know that the fees you’re paying can have a big impact on your retirement savings?

Let’s say, for example, that you have $100,000 in your super fund. If your fund charges fees of 2% per year, then you’ll pay $2,000 in fees each year.

But if you choose a low fee fund that charges 0.5% per year, you’ll only pay $500 in fees. That’s a difference of $1,500 per year!

Over time, those higher fees can really add up. If you’re in a high fee fund for 10 years, you could end up paying $10,000 in extra fees. That’s money that could have gone towards your retirement savings

When comparing super funds, it’s important to look at the total fees charged, not just the management fees. Some high fee funds have high administration and/or insurance fees, which can eat into your returns.

However high fee super funds may also offer a wider range of features and benefits such as personalised advice and support.

While fees are an important factor to consider, it’s not always as simple as picking the fund with the lowest fees. You’ll want to make sure you’re getting the features and benefits that are right for you. You will need to consider things like fund performance, investment options, insurance, and the level of service you need.

The most important thing is to start thinking about your super early – the sooner you start, the more time your money has to grow. So get informed, compare your options and make the best decision for your future self!

What Next?

Check to see what fees you are currently paying with your super fund. Consider other super fund options available to you, specifically low fee funds, to ensure you have the right one for your circumstances.

You can download the eairwoman app to explore the various calculators and projections, including:

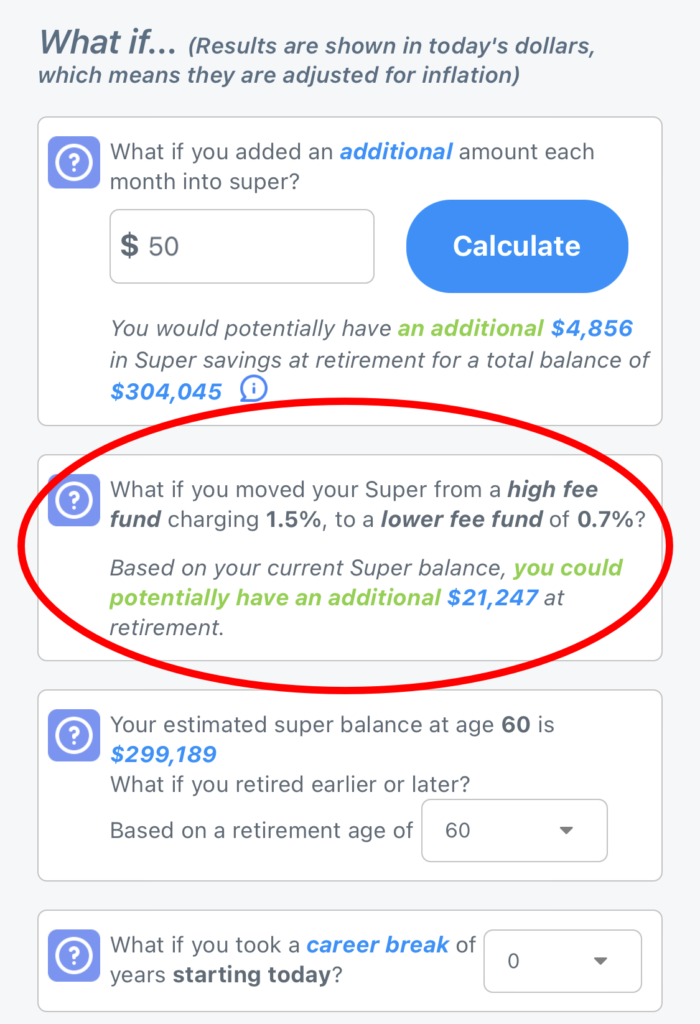

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

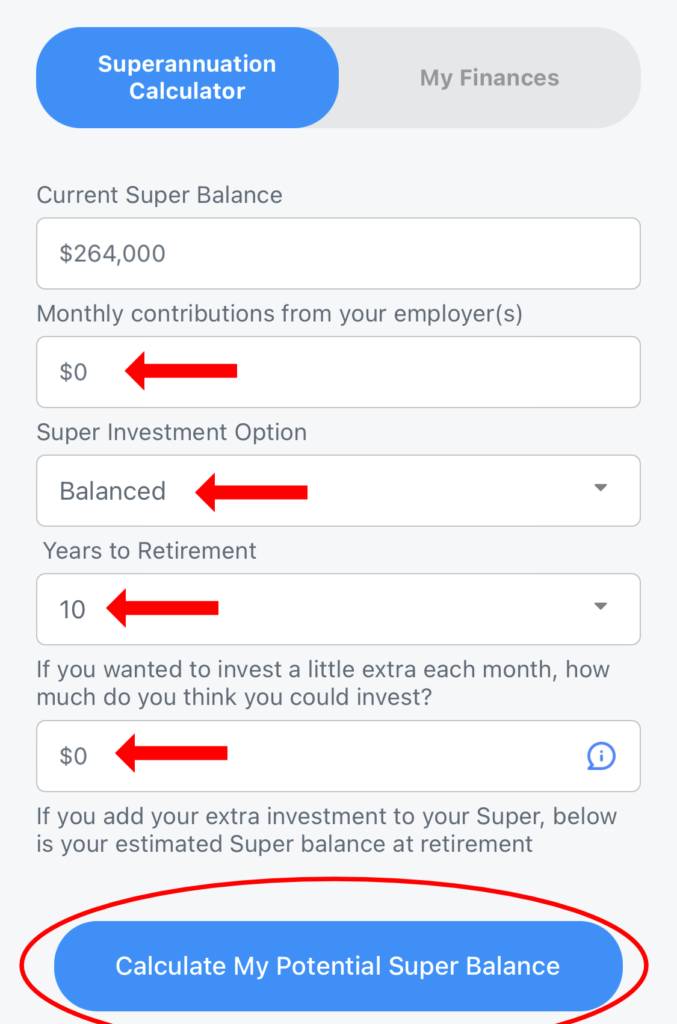

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance.