Maternity leave is a crucial consideration for Australian women planning to start or extend their families.

Knowing the A to Z of how maternity leave works, from eligibility to payments and how to access government assistance through Centrelink, is necessary for effective financial planning.

This guide provides a comprehensive overview of what you need to know about maternity leave in Australia.

Understanding Maternity Leave in Australia

In Australia, maternity leave is formally recognised as Parental Leave and is available to eligible working parents to care for their newborn or recently adopted child.

Casual employees are also entitled to parental leave benefits, provided they meet certain criteria.

Parental leave entitlements are outlined in the Fair Work Act 2009, which provides guidance on the eligibility criteria, the duration of leave, and employer obligations.

Points to Remember

- Duration – Parental leave in Australia allows up to 12 months of unpaid leave for eligible employees, with the option to request an additional 12 months. Employees taking unpaid parental leave are entitled to specific conditions and rights, including the ability to extend the leave and guarantees for returning to work.

- Job Protection – Employees are entitled to return to their previous role or an equivalent role after the leave period.

You can read more about your rights and obligations under the Fair Work Parental Leave guidelines.

Eligibility for Paid Parental Leave

The Australian government offers Parental Leave Pay (PLP) to eligible parents through Centrelink. This payment aims to support working families by providing financial assistance during the initial months following the birth or adoption of a child.

The paid parental leave scheme provides government-funded Parental Leave Pay, which offers a taxable payment at the National Minimum Wage to assist eligible parents while they take leave to care for a newborn or recently adopted child.

Eligibility Criteria

To qualify for Parental Leave Pay, you must:

- Be the primary carer of a newborn or recently adopted child.

- Meet the work test requirements, i.e., you must have worked at least 10 of the 13 months before the birth or adoption, and for a minimum of 330 hours (around one day a week).

- Earn below a specified income threshold, currently capped at $168,865 annually.

- Have been with the same employer for a minimum of 12 months to access specific rights and benefits.

More detailed information on parental leave pay and how it works is available at Services Australia.

Payments and Duration – From the Child’s Birth

Eligible individuals can receive up to 18 weeks of Parental Leave Pay at the National Minimum Wage rate. This payment is designed to replace income for parents, allowing them to focus on their new child without worrying about immediate financial pressures.

Parental leave pay days offer flexibility in how parents can take their leave, with the number of payable days varying based on the child’s care timeline. Parents can combine these days with other leave types, benefiting from shared parental benefits and specific exceptions tailored to different work scenarios.

Additionally, both parents can share the Dad and Partner Pay, providing further support for families where the father or partner takes on caring responsibilities.

Centrelink and How to Apply

If you are planning to claim Parental Leave Pay, you’ll need to go through Centrelink. Here’s a quick guide on what you’ll need to do:

- Create a myGov Account: If you don’t already have a myGov account, you’ll need to set one up and link it to Centrelink.

- Prepare Documents: Gather essential documents like proof of birth, employment records, and identification.

- Submit Your Claim: Log into myGov, navigate to the Centrelink section, and submit your claim for Parental Leave Pay.

Employer Obligations and Additional Support

Employers also have a responsibility to provide a supportive environment for returning parents.

Employees who have worked for at least 12 months are eligible for up to 12 months of unpaid parental leave for the care of a child or adopted child, subject to various conditions and notices required for taking this leave.

It is necessary to check with your employer to understand any additional leave policies, benefits, or flexible working arrangements offered in addition to the government’s Parental Leave Pay.

For Employers

Employers may offer paid maternity leave beyond the government-provided PLP. For example, some companies in Australia offer up to 14 weeks of paid maternity leave, as highlighted by Westpac’s guide.

Financial Considerations and Reduced Earnings Capacity

Returning to work after maternity leave can come with its own set of challenges. Research from the Australian Institute of Family Studies (AIFS) highlights that many women face reduced earning capacity due to career interruptions.

Paid parental leave is important in providing financial support to new parents, helping to mitigate some of these financial challenges. It is crucial to consider these factors while planning your leave and return to work.

For a deeper understanding of the financial implications, you can refer to the research article on reduced future earning capacity.

What Next?

Tips for Using the eairwoman App to Plan for Maternity Leave

Preparing for maternity leave involves more than understanding your leave entitlements – it’s essential to plan how a career break might impact your long-term financial goals.

This is where the eairwoman app can be a vital tool in your financial planning journey.

Explore Your Choices Through ‘What-If’ Scenarios

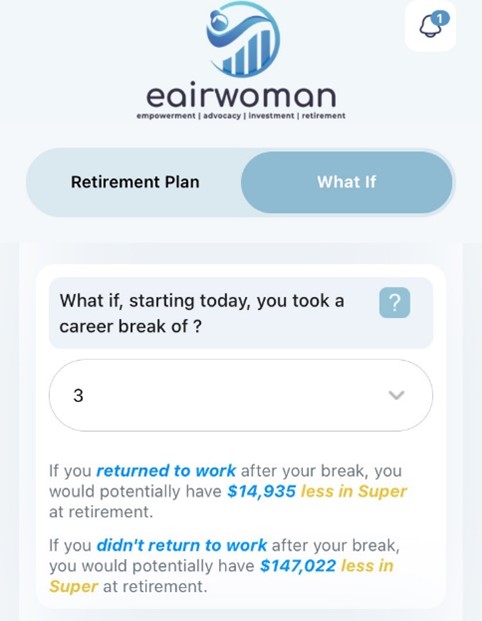

The eairwoman app offers a unique feature called the “What-If” scenario calculator.

This tool allows you to visualise and plan for different life events, like taking a career break for maternity leave.

With this feature, you can explore how changes in your work situation might impact your superannuation balance and retirement savings over time.

Here’s what the “What-If” feature allows you to do:

- Evaluate the Financial Impact of Maternity Leave – By inputting details of your planned career break, the app projects how your super savings and overall financial health could be affected. This helps you weigh the financial pros and cons of taking time off work.

- Adjust Your Contributions – Curious about the effect of making additional super contributions? You can experiment with increasing your contributions to see how it could offset the financial impact of a career break.

- Visualise Multiple Scenarios – The app enables you to test out different scenarios, like extending your leave or taking multiple breaks over the years. This way, you get a clear picture of how each decision might affect your long-term financial goals.

Why This Matters

Understanding the financial implications of maternity leave is crucial for making informed decisions. Many women face reduced super balances due to time off work, which can significantly impact their retirement savings.

The “What-If” feature empowers you to make proactive adjustments, such as increasing voluntary contributions before or after your leave, to ensure you stay on track for a secure retirement.

Take a look at our previous article providing an in-depth guide on Super.

Let’s Help You Take the Steps to Secure Your Family’s Financial Future

Maternity leave is a significant life event that requires careful planning and a clear understanding of your entitlements, payments, and financial options.

In Australia, parents have access to various government supports like Parental Leave Pay, and employers are required to protect job positions during unpaid leave periods. Understanding your rights and leveraging planning tools can help you maintain financial stability and security.

eairwoman is dedicated to empowering Australian women to take control of their financial futures. The app provides personalised insights and practical tools to help you navigate major life changes, like maternity leave, and plan effectively.

Download the App and Start Planning Today

Get ahead today and download the eairwoman app.

For more information or further assistance, visit our FAQ and contact page.