Giving gifts and travelling are two of the many joys that come with retirement. For some, retirement is a time to finally relax and enjoy a well-deserved break from the grind of work. For others, it’s an opportunity to pursue new hobbies and interests. No matter how you choose to spend your retirement, there’s no reason why you can’t include giving gifts and holidays as part of your post-retirement plans.

There are lots of benefits to travel and gift giving. Travelling is not only a great way to see new places, but it can also be a great bonding experience for families and friends. While post-retirement spending on gifts and holidays can be a great way to show your loved ones how much you appreciate them.

It is no secret that post-retirement spending on gifts and holidays can be a major financial burden. Even though most people are happy to be retired, the costs associated with this new lifestyle can be staggering.

One of the best post-retirement gifts you can give is the gift of time and attention. Whether it’s taking your grandchildren to the park or simply spending an afternoon chatting with a friend, quality time is always appreciated.

Holidays can be a great time to relax and enjoy some much-needed leisure time. But they can also be a great opportunity to reconnect with loved ones and create new memories. Whether you want to take that trip around the world, or simply explore local options, retirement is the perfect time to do it.

Of course, when it comes to post retirement spending on gifts and holidays, you’ll want to make sure you budget carefully so you don’t overspend.

What Next?

Download the eairwoman app to explore the various calculators and projections, including:

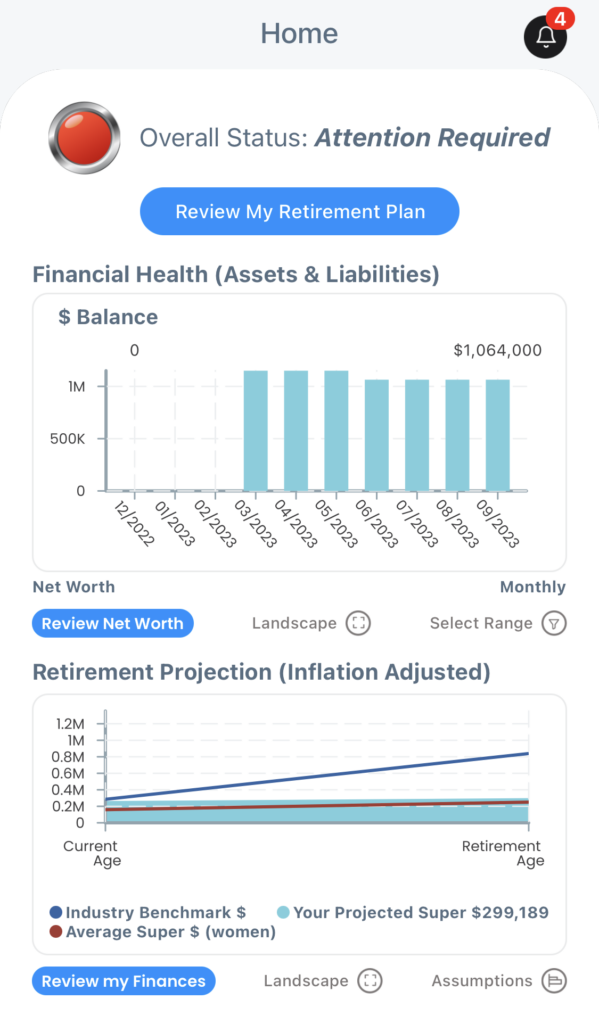

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection as compared to the ASFA Retirement Standard.

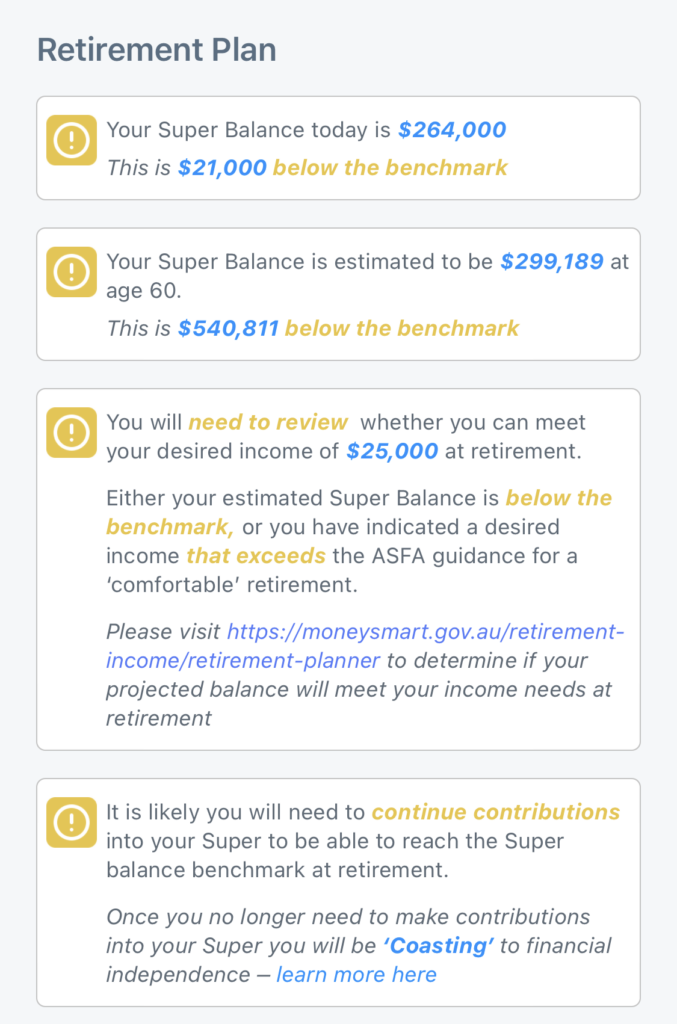

Retirement Plan – projections of your current retirement against the ASFA standard, along with ‘What If’ calculators to see what difference various scenarios would make.

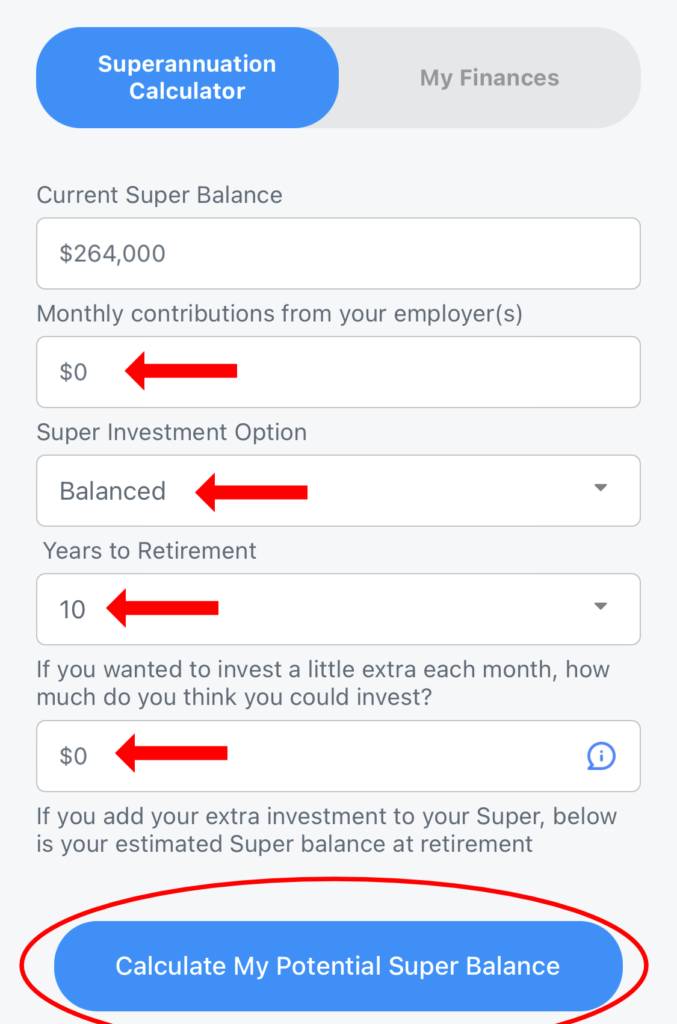

My Finances -> Superannuation Calculator – See what changes to investment options, contributions and retirement date would make to your superannuation balance.