Women have come a long way in breaking financial barriers, from earning their own income to thriving in the investment world.

A 2017 Fidelity study found that women’s investment portfolios outperformed men’s by 0.4%, showing their ability to make calculated and thoughtful financial decisions.

At eairwoman, we believe every woman deserves financial freedom.

This article will explore the challenges women face in investing, why it’s essential to invest, and actionable tips for building wealth in 2024.

Why Women Aren’t Making the Leap to Invest

1. They Don’t Know Where to Begin

The overwhelming amount of information available about investing can make it difficult for women to start placing their bets. Knowing where to begin is often the biggest hurdle to overcome.

2. Priority on Saving Over Investing

According to The Guardian, women tend to focus on saving rather than investing. While saving is essential, investing offers the potential for long-term growth that savings alone cannot provide.

3. Money Is Already a Concern

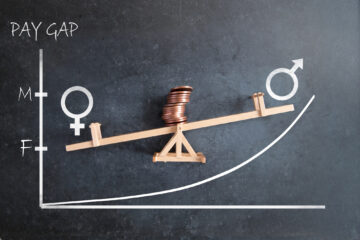

Factors like the gender pay gap, maternity leave, and working casual or part-time (women’s workforce participation) often leave women prioritising financial stability over investment risks. These challenges make saving the more accessible option for many women.

4. Women Are Depicted as More ‘Risk-Averse’

The narrative that women are risk-averse has long discouraged them from investing. In reality, women are risk-aware—they take a calculated, informed approach to investing, which often leads to better outcomes.

Why Should You Invest as a Woman?

Investing is one of the most powerful ways to achieve financial freedom. For women, investing also plays a critical role in ensuring a secure retirement. As highlighted in our article on retirement planning, women retire with significantly less money than men. By investing, you can bridge this gap and work toward a future of financial independence.

Smart Investment Tips for Women in 2024

1. Learn All About the Game Before Playing It

Investing can be a powerful tool for growing your wealth, but it’s important to understand the basics before you start. Take the time to research different options and ensure you’re confident in how each investment works to help you make informed decisions.

Resources to explore:

- Women and Wealth Podcast

2. Start Small

Investing doesn’t have to involve large sums of money. Start with small, manageable amounts, and gradually increase your investments as you gain confidence. One great way to begin is through micro-investing, which allows you to invest small amounts, even spare change, into diversified portfolios. This method makes investing accessible and less intimidating for beginners.

Micro-investing apps like Raiz or Spaceship are popular options in Australia, enabling users to round up everyday purchases and invest the difference.

As highlighted by ABC News, many women find this approach a low-risk way to enter the investing world, allowing them to build confidence over time. It can help you develop a habit of consistent investing, even with limited funds.

Starting small not only lowers the barrier to entry but also lets you learn as you grow, setting the foundation for long-term wealth creation.

3. Know Your Own Financial Situation & Diversify

Before investing, ensure you have a clear picture of your financial health. Assess your income, expenses, and savings to determine what you can afford to invest. According to Commsec, considering your age and investment timeframe is another important factor in determining how much risk you can take when it comes to investing.

The best way to overcome these risks is to diversify your portfolio – meaning to invest in several companies across a wide range of sectors or asset classes rather than one company or type of share. This ensures balance in your investment portfolio as different industries will do well or poorly across different times.

4. Be Disciplined, Be Patient

Investing is a long-term game. By being patient, avoiding emotional decisions, and remembering that patience often yields the best returns. Dollar cost averaging is an investment strategy where you consistently invest rather than pay in one lump sum.

Share prices naturally go up and down, so if you invest your $1,000 when prices are high, you’ll end up with fewer units compared to investing when prices are lower. Since no one can predict exactly when prices will rise or fall, using a strategy like dollar cost averaging can help reduce the risk of investing all your money at once when prices are at their peak.

By spreading your investments over time, you can balance out the highs and lows.

5. Stay Consistent

By looking at a chart of the Standard and Poors 500 Index, it can be seen that index has never lost money in the longer term.

The index is made up of the best performing companies selected by the analysts at Standard and Poors. Only the best performing companies are included in the index therefore the index always grows in the long term.

The key is to hold on during all the downturns and not give in to fear and sell up. The index has always returned to profitability after a downturn, ever since the S&P 500 index began in 1928.

By staying consistent, eventually your returns will grow over time.

5. Align Investments to Your Values

Invest in companies and industries that align with your values. Ethical investing allows you to grow your wealth while supporting the causes you believe in. Whether it’s renewable energy, gender equality, or sustainable practices, choosing investments that reflect your principles can make a positive impact. Not only does this approach help align your financial goals with your personal beliefs, but it also encourages businesses to prioritise social and environmental responsibility.

6. Seek Advice from a Financial Professional

When it comes to investing, getting guidance from a qualified financial expert can make a big difference to your financial future. A professional can help you create a custom strategy, clarify complex financial concepts, and identify investments aligned with your goals and risk tolerance.

Finding the right financial expert is essential. Begin by looking for someone who is licensed, experienced, and understands your unique financial needs. According to Australian Women’s Weekly, it’s important to ask them about qualifications, fees, and areas of expertise before hiring a financial adviser.

You can also explore platforms like MoneySmart to locate accredited advisers in your area. Whether you’re looking for advice on superannuation, ethical investing, or long-term wealth planning, a financial expert can help you take charge of your investment journey.

7. Use the eairwoman App to Stay on Track

Our eairwoman app is your go-to tool for managing your investments.

Track your financial progress, use the “What-If” scenarios to explore potential outcomes, and stay organised—all in one place.

Take Charge of Your Financial Future

Investing as a woman isn’t just about building wealth—it’s about taking control of your financial future and breaking down the barriers that have long limited women in finance.

Start small, stay informed, and use tools like our eairwoman app to guide your journey.

Download the eairwoman app today, and let’s help you gain financial freedom.