If you’re like most people, you’re probably looking for ways to save money on household expenses after retirement. Here are a few changes you can make to your home and household expenses post retirement that can help you stay within your budget.

One way to save money on household expenses is to downsize your home. If you’re no longer working, you may not need as much space as you did when you were raising a family. Moving to a smaller home can help you reduce your housing expenses and free up some extra cash.

There are many other ways to save on your home and household expenses post retirement.

Here are a few tips to get you started:

- Make changes to you home to make it more energy efficient. This may mean draft proofing your home, adding insulation or switching to energy-efficient lighting and a hot water heat pump.

- When replacing appliances choose energy-efficient options

- Install solar panels to dramatically reduce your power use and also take advantage of any government subsidies available to retirees for solar panels

- Shop around for the best deals on insurance, utilities, and other household expenses.

- Be sure to comparison shop for big-ticket items

- Turn off appliances when not using them

Finally, you can save money on household expenses by eliminating unnecessary expenses. Take a close look at your budget and see where you can cut back. By making a few simple changes, you can save a significant amount of money on your household expenses.

What Next?

Download the eairwoman app to record your household expenses, not just what they are today, but on going all the way up to retirement. You’ll find this under ‘My Finances’/’My Finances’/Income & Expenses

Once you’ve entered your current expenses into the eairwoman app, see which expenses you may be able to reduce or eliminate altogether.

You can also use the eairwoman app to explore the various calculators and projections, including:

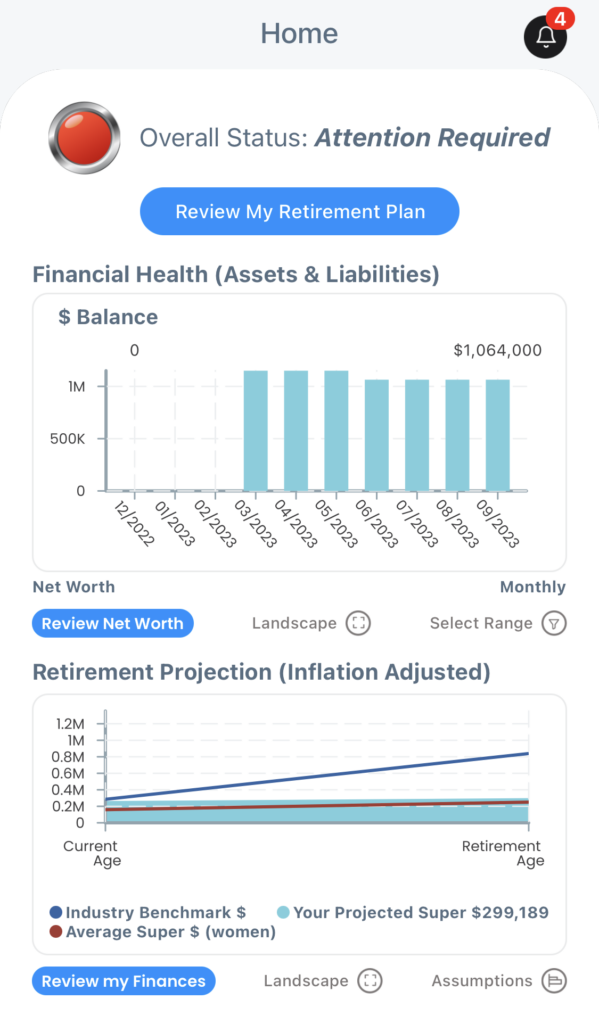

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection as compared to the ASFA Retirement Standard.

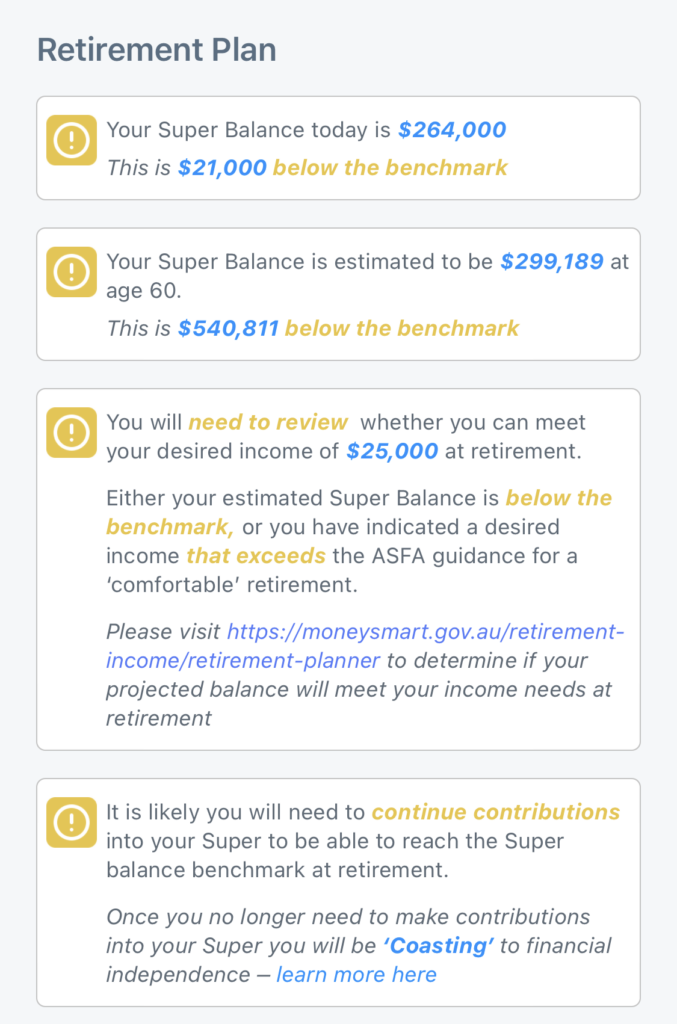

Retirement Plan – projections of your current retirement against the ASFA standard, along with ‘What If’ calculators to see what difference various scenarios would make.

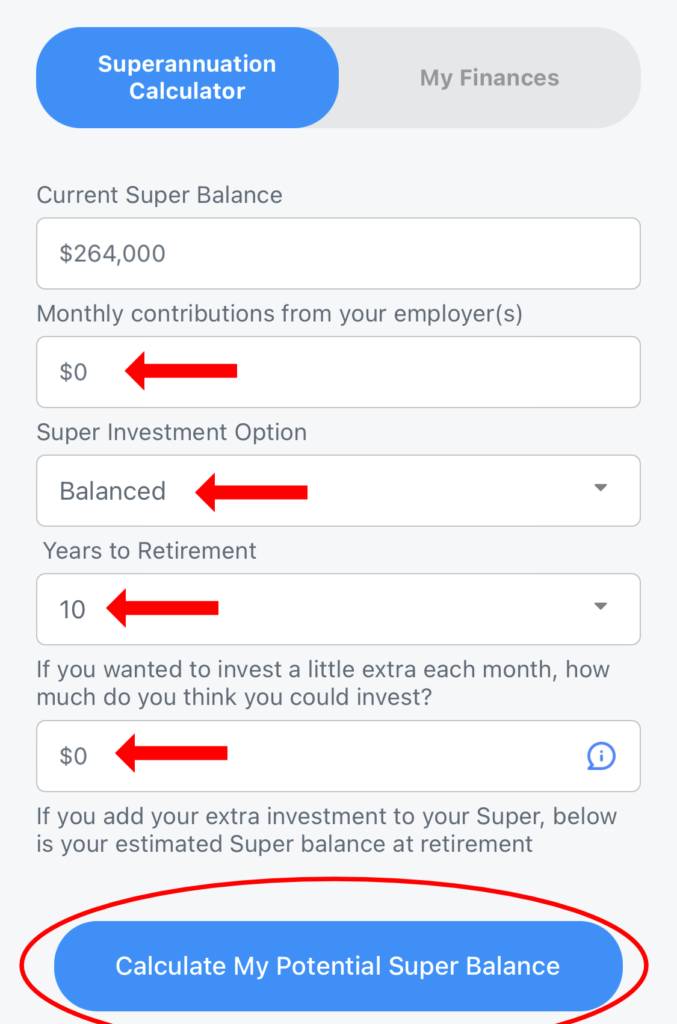

My Finances -> Superannuation Calculator – See what changes to investment options, contributions and retirement date would make to your superannuation balance.