- More than 80% of women in Australia will not have enough saved to fund a ‘comfortable lifestyle’ at retirement.

- Women on average will retire with $70,000 less than men.

- Half of all women aged 45 to 59 currently have less than $8,000 in their super funds.

- The average superannuation payout for women is roughly a third of that for men. $37,000 for women compared to $110,000 for men.

(Sources: https://humanrights.gov.au/our-work/gender-gap-retirement-savings & https://www.superguru.com.au/about-super/women-and-super)

For most women, retirement planning is a necessary but daunting task. There are a number of financial factors to consider in order to ensure a comfortable retirement, especially if you are on a low income or have taken career breaks.

The good news is that there are a number of ways to boost your retirement savings. Superannuation is one of the most important tools for women when it comes to planning for retirement. Employer contributions, government incentives and compound interest can all make a big difference to your final super balance. Retirement planning can be a complex process, but it is important to start planning early to give yourself the best chance of success.

In this blog series, we’ll discuss three of the most important aspects to consider in retirement planning.

What Next?

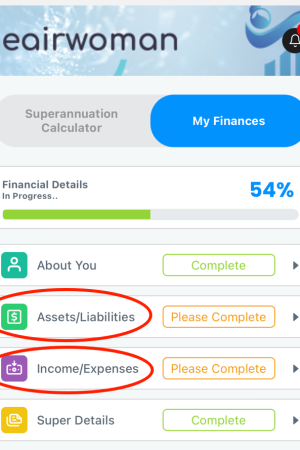

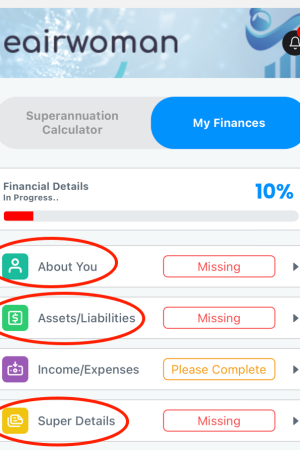

Step 1) Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed all the Missing/Mandatory fields under My Finances. At this point you should be seeing your initial retirement projections under Home and Retirement Plan.

Step 2) Write down your other financial details, including the sections Assets/Liabilities and Income/Expenses. This is an important step to complete. The eairwoman app will then give you greater insight into your overall financial health, and ultimately help you to achieve your retirement goals.