When it comes to superannuation, there are a range of investment options available. From low-risk options such as cash and fixed income, to higher-risk options such as shares and property.

Most super funds allow you to choose between ‘Pre Mixed’ investment options. The default option typically being ‘Balanced’ which invests across a range of investment assets, including shares, property and cash. ‘High Growth’ which has a larger investment in shares, and ‘Stable’ which focuses on fixed interest and cash.

Generally speaking, the higher the potential return on your investment, the higher the risk. That means that if you’re looking for higher returns, you need to be prepared to accept more risk. Generally speaking, the younger you are, the more time you have to recover from any market ups and downs. This means you can afford to take on more risk in your investments, in exchange for the potential of higher returns.

But remember, when it comes to risk and investment returns, there is no one-size-fits-all approach. It’s important to consider your personal investment goals, risk tolerance, and time horizon when choosing an investment option. Seek professional advice if you’re unsure about anything.

Further Reading

https://www.superguru.com.au/about-super/how-does-super-work

What Next?

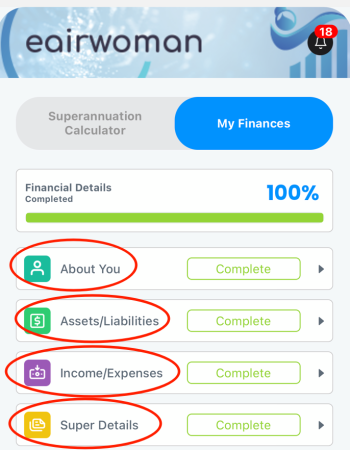

Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed filling out all your personal and financial details in the eairwoman app.

You are now ready to start exploring the various calculators and projections with the eairwoman app, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference various scenarios would make.

My Finances -> Superannuation Calculator – See what changes to things like contributions, investment options and retirement date would make to your superannuation balance

Actions – Things to do now and into the future to help secure the best possible outcome in retirement