There are a number of things you can do to maximise your superannuation.

One is to make sure you are being paid the Super Guarantee. This is the minimum amount your employer must contribute to your super fund. You should speak to your employer if you are not being paid the Super Guarantee.

You can also make additional contributions to your super fund. This can be done through salary sacrificing or making personal contributions.

You can choose to invest your super in a variety of different investment options. This can help you to grow your super and make the most of it.

Another thing you can do is to make sure you have the right insurance in place. This can help to protect you and your family in the event of your death or illness.

Finally, there are options on how you access your super when you retire. This can be done through a super pension or lump sum withdrawal.

The good news is eairwoman can help. There are a number of ways to make the most of your superannuation. These include how much you contribute, where it’s invested and when you choose to retire. All of these can be modelled in the eairwoman app with ‘What If’ scenarios. This will show you the impact of changing any of these factors.

See below for a summary of where to start exploring.

Further Reading

https://www.superguru.com.au/about-super/how-does-super-work

What Next?

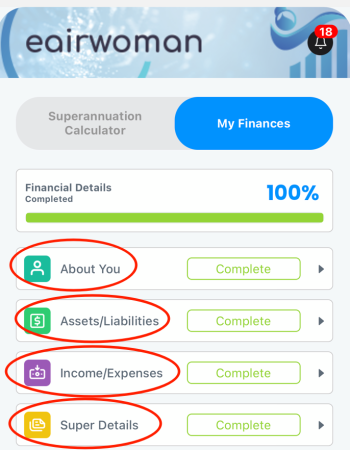

Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed filling out all your personal and financial details in the eairwoman app.

You are now ready to start exploring the various calculators and projections with the eairwoman app, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference various scenarios would make.

My Finances -> Superannuation Calculator – See what changes to things like contributions, investment options and retirement date would make to your superannuation balance

Actions – Things to do now and into the future to help secure the best possible outcome in retirement