Why compare superannuation funds?

- It is important to find a fund that best suits your individual needs and circumstances.

- Different funds have different fees and charges which can impact your retirement savings.

- Comparing super funds can help you to find the best performing fund for your needs.

How do you compare super funds?

There are a number of ways to compare superannuation funds in Australia. The easiest way is to use one of the many comparison websites that are available. Some of these websites include Canstar, MoneySmart and SuperRatings.

When comparing super funds there are a few things to consider. Firstly, you need to think about what your goals are. Do you want a fund that offers a good return on investment? Or are you more concerned with fees and charges?

Once you know what your priorities are, you can start looking at different super funds and comparing their features.

When comparing superannuation funds, it is important to consider all of the features and benefits that each fund offers. By doing this, you will be able to choose the fund that best suits your needs. Some factors you may want to consider when comparing super funds are fees, performance, investment options and insurance cover.

When considering performance, keep in mind that past performance is no guarantee of future results. So even if one fund has performed well in the past, there’s no guarantee it will continue to do so in the future.

Another way to compare super funds is to seek professional financial advice. A qualified financial adviser can help you compare different funds and find the best one for you.

Finally, don’t forget to take your own personal circumstances into account. What’s important to you may not be as important to someone else. So make sure you’re choosing a super fund that’s right for you.

What Next?

Check to see where your super is currently invested. See what investment option you currently have selected and the associated level of risk. That is, what percentage are invested in shares, property, cash and fixed interest. Also review the fund performance, what fees you are paying and insurance options selected.

Once you have identified your personal goals and priorities, you can start your comparison.

You can download the eairwoman app to explore the various calculators and projections, including:

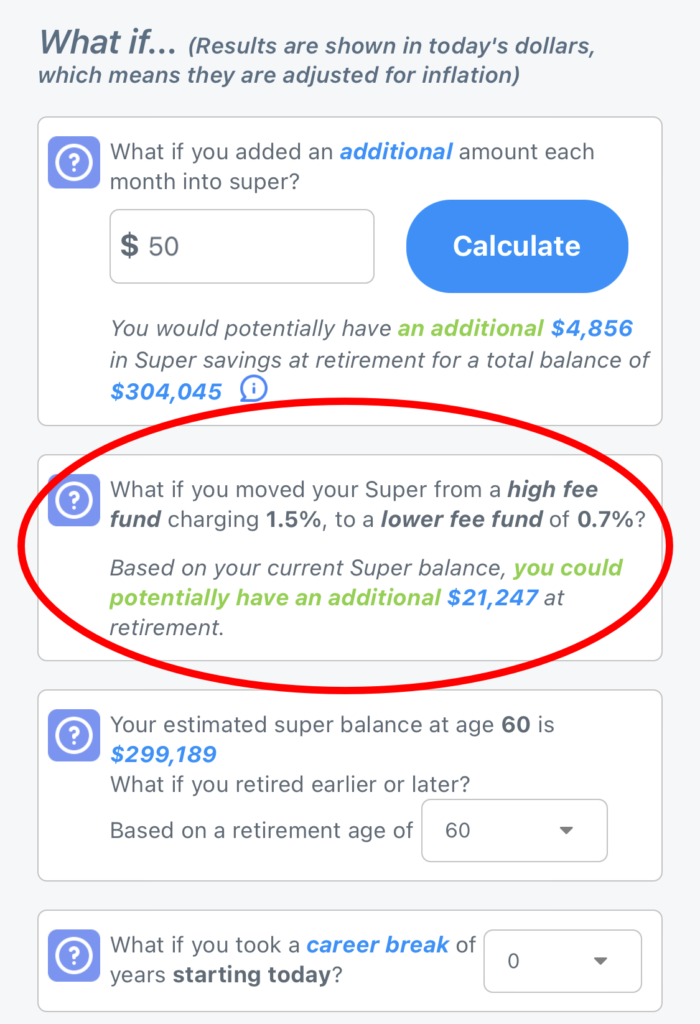

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

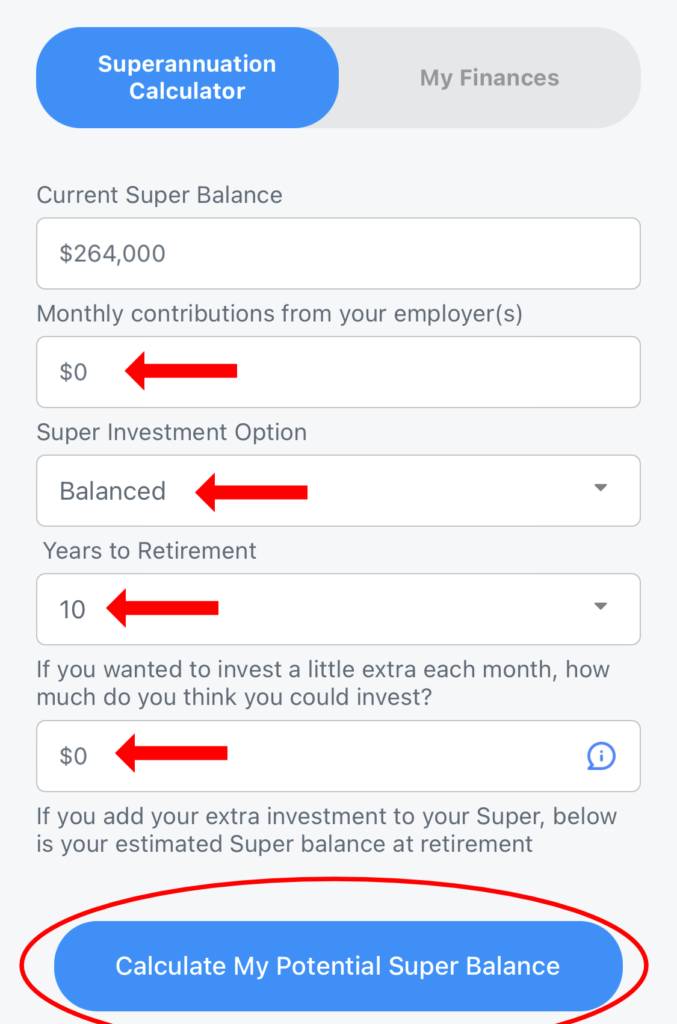

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance.