How to overcome the gender pay gap and save for retirement?

There’s no one answer to the question of how to overcome the gender pay gap and save for retirement. But there are a few key steps that can make a big difference.

For starters, it’s important to understand the gender pay gap and how it affects you. The gender pay gap is the difference between what men and women are paid for doing the same job. It’s a problem because it means that women are starting out behind men when it comes to retirement savings.

There are a few ways to close the gender pay gap. One is to negotiate for fair pay when you start a new job. Another is to ask for a raise at your current job. And finally, you can make sure to save as much as possible for retirement.

Some women may feel like they can’t save enough for retirement because they have low incomes. But there are ways to save. One of the best ways is to create a budget and stick to it.

Even if your employer is contributing to your super, consider supplementing it with your own savings. Employer sponsored plans are important, but they may not be enough to give you the lifestyle you want in retirement. If you want to retire sooner or retire in luxury, you’ll need to do your own saving and investing.

Start to plan for retirement early. One of the most significant advantages of starting to plan for retirement early is the power of compound interest. The earlier you start saving for retirement, the more time your money has to grow.

Career breaks can also impact your retirement savings. If you take a break from work, make sure to keep contributing to your retirement account.

What Next?

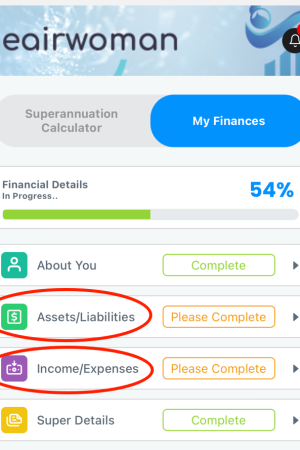

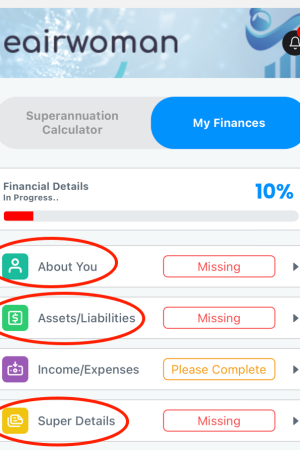

Step 1) Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed all the Missing/Mandatory fields under My Finances. At this point you should be seeing your initial retirement projections under Home and Retirement Plan.

Step 2) Write down your other financial details, including the sections Assets/Liabilities and Income/Expenses. This is an important step to complete. The eairwoman app will then give you greater insight into your overall financial health, and ultimately help you to achieve your retirement goals.