Your super fund is there to help you save for retirement. But did you know that most super funds also offer insurance? Insurance can give you and your family peace of mind, knowing that you’re covered financially if something happens to you.

There are a number of different types of insurance that can be included in a super fund, such as death cover, total and permanent disability cover, income protection cover. The level of cover and the premiums you pay will depend on factors like your age, gender, occupation, and cover amount.

There are a number of benefits to having insurance through your super fund. For example, it can be cheaper than if you took out a separate policy, and it may be easier to claim on your insurance through your super fund than it is to claim on a separate policy.

Your super fund provides you with important benefits and insurance cover, so make sure you are getting the most out of it. Review your cover regularly and make sure you are comfortable with the level of cover you have. If you have any questions, speak to your super fund or financial adviser.

What Next?

Check to see what insurance is available in your current super fund. Consider what options are available to you to ensure you have the right one for your circumstances.

You can download the eairwoman app to explore the various calculators and projections, including:

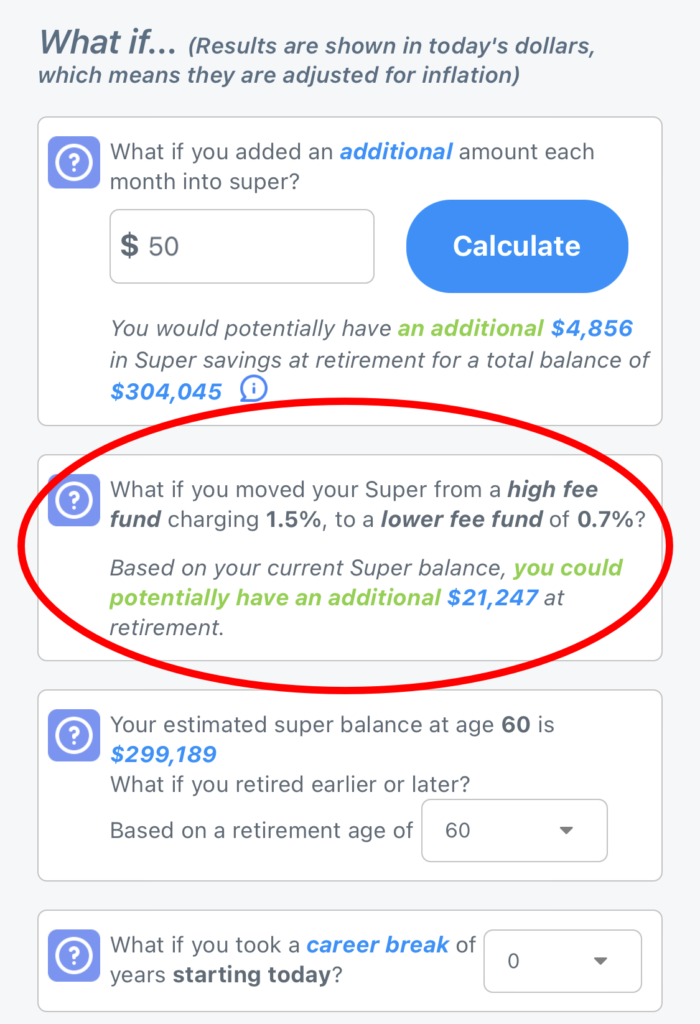

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

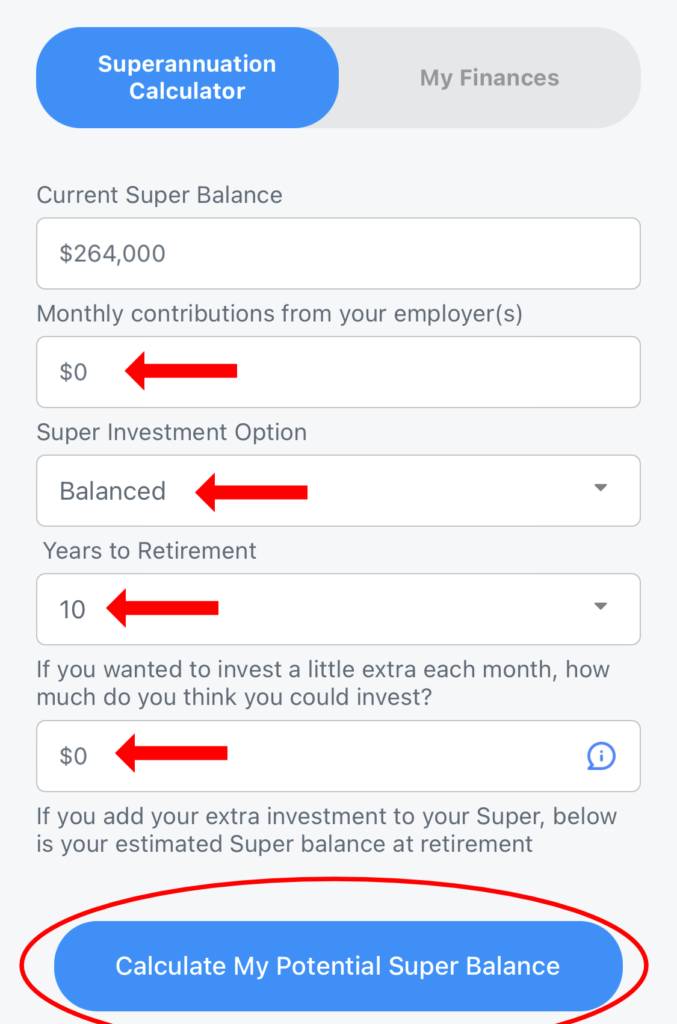

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance.