Fund performance is typically measured by looking at the fund’s total return, which is the fund’s percentage gain or loss over a certain period of time, typically one year.

When it comes to choosing a super fund, performance is definitely an important consideration.

Super funds are required to disclose their investment performance annually. This information can be found on the fund’s website and product disclosure statement (PDS).

When comparing performance of different funds, be aware performance is measured over different time periods, so it’s important to compare like-for-like. For example, if you’re looking at 10-year performance, make sure you’re comparing 10-year performance of different funds.

It’s also important to understand there are a number of factors that can affect a fund’s performance.

These can include:

- Investment strategy of the fund manager

- Type of assets (classes) the fund invests in

- Overall performance of the markets

- Fees charged by the fund manager

- Quoted returns including or excluding the percentage for inflation.

Keep in mind that past performance is not a guarantee of future returns. There are a number of reasons why past performance is not always indicative of future performance, including changing market conditions and the experience of a company’s fund management team.

What about the risks when seeking higher performance?

Risk and return are always linked. An investment with higher potential return always comes with more risk. For example, buying stocks is generally more risky than bonds, but over the long term, stocks have outperformed bonds.

One way to manage risk is diversification. By investing in a mix of asset classes, you can help to offset the risks of any one investment class.

When choosing a super fund, performance is one of many factors to consider. Investment fees and costs are also important to consider as they can have a significant impact on your investment performance. The fees you pay can take a big bite out of your returns. That’s why it’s important to understand the fees you’re paying, and how they impact your bottom line.

Although there is no guaranteed way to achieve best performance, by understanding risk and return you can make more informed decisions about where to invest your money.

What Next?

Check to see where your super is currently invested. See what investment option you currently have selected and the associated level of risk. That is, what percentage are invested in shares, property, cash and fixed interest. Also review the fund performance and what fees you are paying.

With this information you’ll be better informed when considering other super fund options available to you, and ensure you have the right one for your circumstances. You may find the right option for you from your current fund manager, for example, by moving from a ‘Stable’ to a ‘Balanced’ option with your existing fund manager. Or, you could find the right option by moving your super to a different fund manager. We’ll look into how to go about comparing super funds in an upcoming blog.

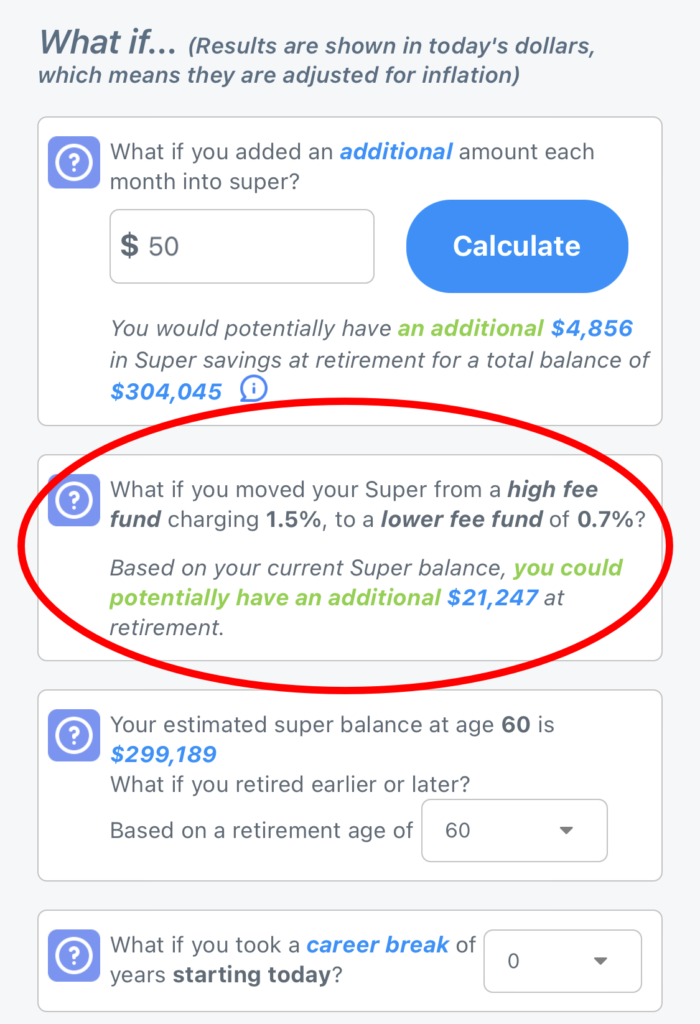

You can download the eairwoman app to explore the various calculators and projections, including:

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference changing from a high fee fund to low fee fund would make to your retirement.

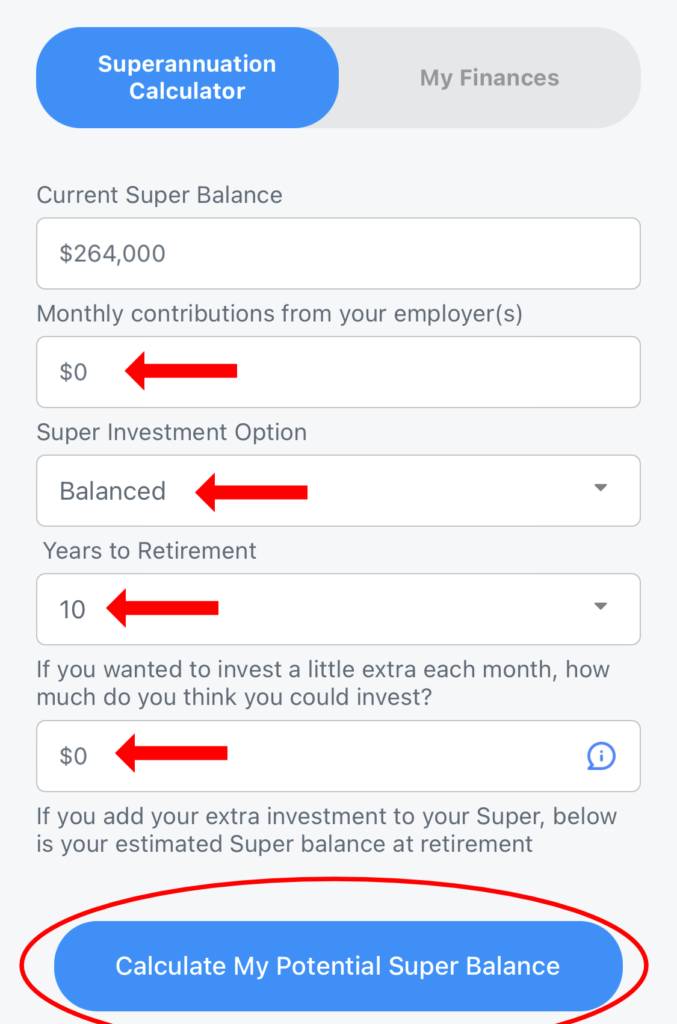

My Finances -> Superannuation Calculator – See what other changes to investment options would make to your superannuation balance, including moving to a higher performing fund.