Superannuation is a system in Australia that provides for retirement savings. The mainstay of the system is the Superannuation Guarantee (SG), which is the minimum amount that employers must contribute to their employees’ superannuation. However, employees can also make voluntary contributions to their super. The current Super Guarantee rate is 9.5% of salary. This rate is set to increase gradually over time, with the aim of eventually reaching 12%.

The money in your super fund is then invested, with the aim of growing your savings over time. There are two types of superannuation funds in Australia – retail funds, which are offered by financial institutions, and industry funds, which are typically run for the benefit of it’s members.

You can access your super when you reach what is called your “preservation age”. For most people, this age is between 55 and 60. When you reach your preservation age, you can start to access your super as a lump sum or as an income stream

Further Reading

https://www.superguru.com.au/about-super/how-does-super-work

What Next?

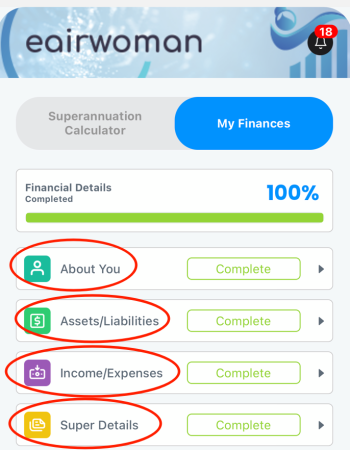

Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed filling out all your personal and financial details in the eairwoman app.

You are now ready to start exploring the various calculators and projections with the eairwoman app, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference various scenarios would make.

My Finances -> Superannuation Calculator – See what changes to things like contributions, investment options and retirement date would make to your superannuation balance

Actions – Things to do now and into the future to help secure the best possible outcome in retirement