What are the best strategies for women?

When it comes to retirement planning, women often face unique challenges. They tend to live longer than men, which means their retirement savings need to last longer. They also tend to take career breaks to care for children or elderly parents, which can put a dent in their superannuation balances.

Aside from superannuation, it’s also important to consider other retirement savings options, such as investing in property or shares. Building up a buffer of cash is also a good idea, as it can provide a cushion in case of unexpected expenses in retirement.

But with a little planning, women can take control of their financial future and retirement. Here are a few strategies to consider:

- Save early and often: The sooner you start saving for retirement, the better. Even if you can only put away a small amount each week or month, it will add up over time. And don’t forget to keep contributing to your superannuation even if you take a break from paid work.

- Think about your investments: Where you invest your money is just as important as how much you save. Consider talking to a financial adviser about where to invest your money to get the best returns. There are 7 major investment classes to consider. We’ll dive into these in a later blog series

- Create a retirement budget: Take a look at your current spending and work out what you will need in retirement. Then, start making adjustments now to ensure you have enough money to support your desired lifestyle.

What Next?

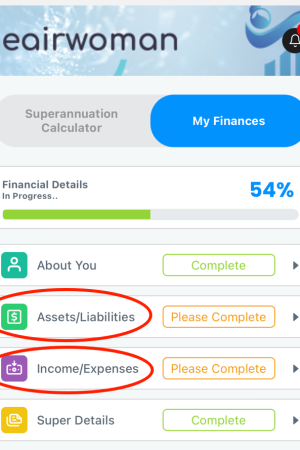

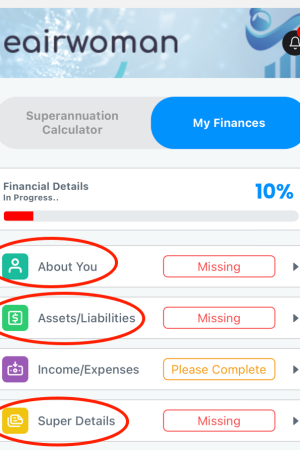

Step 1) Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed all the Missing/Mandatory fields under My Finances. At this point you should be seeing your initial retirement projections under Home and Retirement Plan.

Step 2) Write down your other financial details, including the sections Assets/Liabilities and Income/Expenses. This is an important step to complete. The eairwoman app will then give you greater insight into your overall financial health, and ultimately help you to achieve your retirement goals.