Your super is there to help you live a comfortable retirement. The government guarantee (known as the Superannuation Guarantee) means that your employer must make regular contributions to your super account – currently, they must contribute 10.5% of your salary.

You can also make your own contributions, and many people do. After all, the more you have in your super account, the more comfortable your retirement will be.

But how much do you need? Well, that depends on a number of things, including how long you live and what kind of lifestyle you want in retirement.

That’s where eairwoman can help. There are a number of variables to consider including when you plan to retire, how much you currently have saved, how much extra you can save and your investment returns. All of these can be modelled in the app along with ‘What If’ scenarios if you were to change any of these factors. See below for a summary of where to start exploring.

You can also talk to a financial adviser. They can help you understand your options and make the best decisions for your individual circumstances.

Further Reading

https://www.superguru.com.au/about-super/how-does-super-work

What Next?

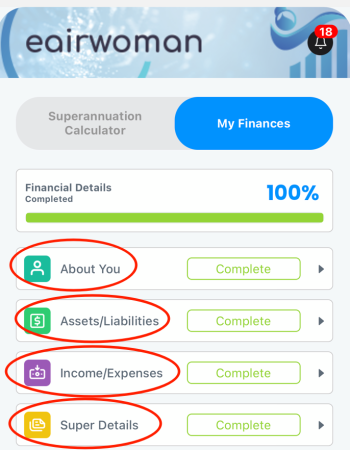

Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed filling out all your personal and financial details in the eairwoman app.

You are now ready to start exploring the various calculators and projections with the eairwoman app, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference various scenarios would make.

My Finances -> Superannuation Calculator – See what changes to things like contributions, investment options and retirement date would make to your superannuation balance

Actions – Things to do now and into the future to help secure the best possible outcome in retirement