Retirement planning is not just about money. It’s also important to consider your health and wellbeing in retirement. This includes making sure you have adequate insurance cover, as well as planning for activities and hobbies that will keep you physically and mentally active.

Planning for healthcare costs in retirement is an important part of financial planning for your later years. Women, in particular need to be aware of the potential costs associated with health care in retirement, as they tend to live longer than men and are more likely to experience periods of low income during their careers due to career breaks for raising families. There are a number of ways to plan for healthcare costs in retirement, including:

- Investing in a good quality health insurance policy. This will ensure that you are covered for a range of medical expenses, including hospitalisation, and can give you peace of mind in knowing that you will be able to access the care you need in retirement.

- Putting aside money each week or month into a dedicated healthcare fund. This can be used to pay for any out-of-pocket expenses not covered by your health insurance, such as dental care or optometry.

- Making healthy lifestyle choices now that will help reduce your future healthcare costs. This includes things like eating healthy, exercising regularly and quitting smoking.

By taking the time to plan for healthcare costs in retirement, you can ensure that you will be able to access the care you need without putting undue financial strain on yourself.

What Next?

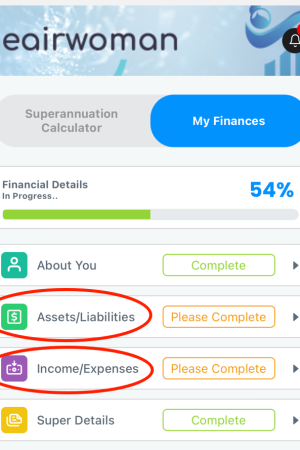

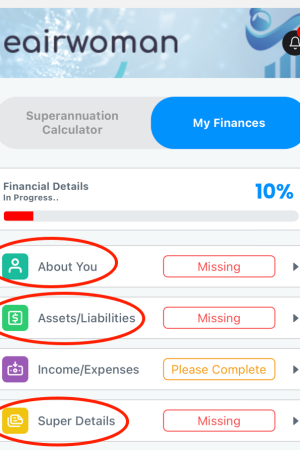

Step 1) Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed all the Missing/Mandatory fields under My Finances. At this point you should be seeing your initial retirement projections under Home and Retirement Plan.

Step 2) Write down your other financial details, including the sections Assets/Liabilities and Income/Expenses. This is an important step to complete. The eairwoman app will then give you greater insight into your overall financial health, and ultimately help you to achieve your retirement goals.