In Australia, superannuation is a long-term savings plan to help you financially in retirement. You can start paying into your super from the day you start work. In most cases, your employer will pay money into your super account (called the Superannuation Guarantee).

The money in your super account can’t be accessed until you reach what’s called your ‘preservation age’. When you reach preservation age (currently, between 56 and 60, depending on your date of birth), you can access your superannuation savings. This can be done through a lump-sum payment, an income stream, or a combination of both. You can also leave your super in the account to continue to grow until you need it.

If you’re thinking about accessing your super early, it’s important to get professional financial advice first. This is because taking money out of your super can have a big impact on your retirement savings.

Further Reading

https://www.superguru.com.au/about-super/how-does-super-work

What Next?

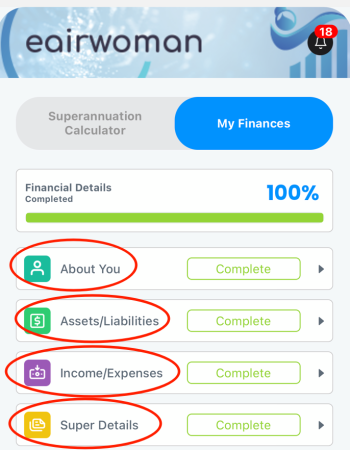

Work out your current finances. You can download the eairwoman app to make it easier if you have an Apple device. Make sure you’ve completed filling out all your personal and financial details in the eairwoman app.

You are now ready to start exploring the various calculators and projections with the eairwoman app, including:

Home – How you’re currently tracking in regards to your overall financial health and retirement balance projection

Retirement Plan – projections of your current retirement, along with ‘What If’ calculators to see what difference various scenarios would make.

My Finances -> Superannuation Calculator – See what changes to things like contributions, investment options and retirement date would make to your superannuation balance

Actions – Things to do now and into the future to help secure the best possible outcome in retirement